Compliance documentation looks great in a binder. But when regulators show up, or worse: when a breach exposes patient records, client tax returns, or tenant applications: that binder doesn't protect you. What actually matters is whether your security controls work in practice, not just on paper.

We've seen too many businesses treat compliance as a one-time event: hire a consultant, fill out forms, file them away, and assume the job is done. Then they face an audit, discover their "compliant" systems haven't been updated in two years, and scramble to fix gaps that should never have existed.

High-stakes compliance isn't about checking boxes. It's about building security frameworks that protect your business, satisfy regulators, and actually function when you need them most.

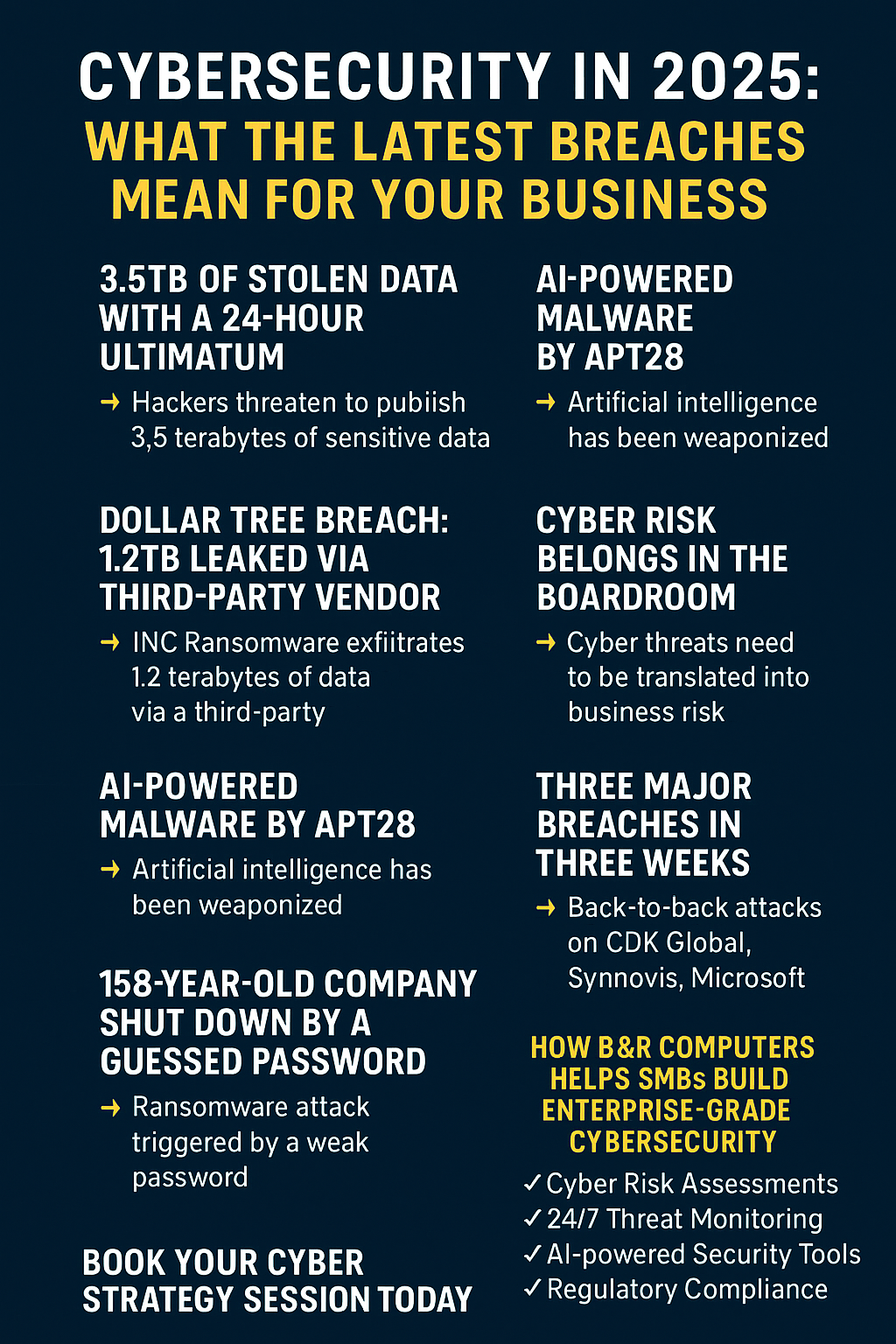

The Real Cost of Reactive Compliance

Most organizations operate reactively. They address compliance issues after violations occur or when audits force action. This approach is measurably more expensive than prevention.

Consider the financial services firm that implements multi-factor authentication only after the FTC identifies it as a deficiency during an examination. Or the healthcare provider that hardens their systems after a breach exposes thousands of patient records. Both scenarios result in emergency spending, potential fines, reputation damage, and operational disruption that proactive planning would have prevented.

According to industry data, organizations implementing proactive compliance strategies: where regulatory obligations are integrated directly into operations from the start: report significantly higher confidence in compliance decision-making and measurably lower incident rates.

The difference is straightforward: reactive compliance treats security as damage control. Proactive compliance treats it as infrastructure.

Healthcare: HIPAA Is Your Floor, Not Your Ceiling

HIPAA compliance starts with understanding that the regulation sets minimum standards, not best practices. The Security Rule's "addressable" specifications give covered entities flexibility: but that flexibility doesn't mean optional.

We regularly encounter healthcare providers who believe encryption is addressable and therefore skippable. That's a dangerous misreading. Addressable means you assess whether the control is reasonable and appropriate for your organization. If you determine it's not, you must implement an equivalent alternative and document your reasoning. "We didn't want to" isn't documentation.

Here's what functional HIPAA compliance looks like:

Risk Analysis That Actually Guides Decisions: Your risk assessment shouldn't be a static document created once and forgotten. It should identify where protected health information lives, how it moves, who accesses it, and what could go wrong. That analysis directly informs which technical safeguards you implement.

Access Controls That Match Workflow: Minimum necessary access isn't just policy: it's configured into your systems. Medical assistants access scheduling and basic patient data. Billing staff see financial information. Clinicians access full medical records. Nobody gets blanket administrative rights because "it's easier."

Encryption Everywhere PHI Exists: Laptops, mobile devices, backup drives, email transmissions, cloud storage. If protected health information touches it, it's encrypted. This isn't paranoia: it's the difference between a reportable breach and a non-event when a device gets lost.

Audit Logging That Actually Captures Activity: Your systems should log who accessed what patient records and when. Not because regulators require it (though they do), but because you need to detect inappropriate access before it becomes a breach.

We build these controls into operational workflows so they strengthen security without disrupting patient care. When compliance and productivity align, both improve.

Financial Services: Navigating the FTC Safeguards Rule and IRS Requirements

Financial institutions and tax professionals operate under layered compliance obligations that overlap but aren't identical. The FTC Safeguards Rule applies to businesses handling consumer financial information. IRS Publication 1345 sets standards for tax preparers. Both demand comprehensive information security programs, but the implementation details matter.

The FTC Safeguards Rule mandates specific controls:

- Designated security coordinator

- Written risk assessment

- Access controls limiting data to authorized personnel

- Encryption of customer information in transit and at rest

- Multi-factor authentication for systems accessing customer data

- Security awareness training

- Vendor management and oversight

- Incident response planning

These aren't suggestions. They're requirements. The FTC has already issued penalties to firms that failed implementation: and those enforcement actions are public, measurable, and expensive.

Tax professionals face additional IRS scrutiny:

The IRS expects tax preparers to implement a Written Information Security Plan addressing physical, technical, and administrative safeguards. That plan must cover:

- Employee access management and background checks

- System security (firewalls, antivirus, regular updates)

- Data disposal procedures

- Breach response protocols

Tax season creates additional pressure. Return data contains everything criminals need for identity theft: Social Security numbers, income details, bank account information, dependent data. Firms handling this information become high-value targets precisely when they're busiest and least able to handle security incidents.

We help financial services firms and tax professionals implement controls that satisfy both FTC and IRS requirements without duplicating effort. Proper access controls protect client data and meet regulatory standards simultaneously. Encryption secures information in transit and at rest regardless of which regulation requires it. Incident response planning addresses both FTC notification timelines and IRS breach reporting obligations.

The goal isn't separate compliance programs for separate regulators. It's integrated security that covers all requirements while remaining operationally practical.

Property Management: FTC Standards for Tenant Data

Property managers handle significant volumes of sensitive information: tenant applications containing Social Security numbers, credit reports, bank statements, employment verification, criminal background checks, and lease agreements. This data makes property management firms targets for identity theft and fraud schemes.

The FTC's standards for safeguarding customer information apply to property managers, though many in the industry don't realize it. Tenant applicant data qualifies as consumer information requiring protection under FTC guidelines.

Practical implementation includes:

Secure Application Processing: Digital application systems should encrypt submissions in transit. Stored applications require encryption at rest and access restricted to staff who genuinely need it for tenant screening.

Physical Document Security: Paper applications still exist. They require locked storage, controlled access, and secure destruction when retention periods expire. Leaving applications in unlocked filing cabinets or office recycling bins creates liability.

Third-Party Vendor Management: Property managers typically use screening services, payment processors, and maintenance coordination platforms. Each vendor accessing tenant data requires vetting, contractual security obligations, and periodic review. Vendor security failures create your security failures.

Data Retention and Disposal: Keep tenant data only as long as legally required or operationally necessary. Develop documented retention schedules and secure disposal procedures.

We've worked with property management firms where tenant applications sat in email inboxes indefinitely, accessible to anyone with mailbox access. Simple changes: encrypted storage, access controls, retention policies: transformed those exposures into manageable, compliant processes.

Our Approach: Proactive Security Frameworks That Make Audits Stress-Free

Strategic compliance transforms mandatory functions into competitive advantages. Organizations that integrate regulatory obligations directly into business operations gain measurable benefits: higher customer trust, better vendor relationships, reduced incident costs, and confidence during audits.

Our methodology focuses on building security infrastructure that serves dual purposes: protecting your business and satisfying regulators:

Risk-Based Implementation: We identify your highest-risk data and processes first. Healthcare providers prioritize electronic health records. Financial firms focus on client account information. Property managers secure tenant applications. Controls address actual threats to your specific operations, not generic security theater.

Documentation That Reflects Reality: Compliance documentation should describe what you actually do, not what you wish you did or plan to do eventually. We help you build processes worth documenting, then create records that accurately reflect those practices. When auditors review your policies and test your controls, they should match.

Continuous Monitoring and Improvement: Compliance isn't static. Regulations evolve. Threats change. Your business grows. We implement monitoring that tracks whether controls remain effective and helps you adapt before problems emerge. This includes regular risk reassessments, security testing, policy reviews, and staff training updates.

Vendor Oversight That Actually Works: Your compliance obligations extend to third-party service providers accessing your sensitive data. We help you develop vendor management processes that verify security practices, establish contractual protections, and monitor ongoing compliance without creating bureaucratic bottlenecks.

The result is operational security that happens to satisfy regulatory requirements, rather than compliance activities bolted onto operations as afterthoughts.

Building Security That Supports Growth

Compliance done right doesn't slow your business: it enables expansion. Prospective clients in regulated industries ask about your security practices. Partners require vendor security assessments. Contracts demand proof of compliance. Having mature, documented, functional security frameworks answers those questions immediately instead of becoming deal obstacles.

We take the burden of regulatory compliance off your shoulders so you can focus on growth. Whether you're navigating HIPAA as a healthcare provider, FTC Safeguards as a financial firm, or FTC standards as a property manager, B&R Computers builds proactive security frameworks that protect your business and keep audits stress-free.

If you're ready to move beyond checkbox compliance to security that actually works, let's talk.