Every tenant application you process contains exactly what hackers want: Social Security numbers, bank account details, employment records, credit reports, and copies of driver's licenses. When you manage hundreds of properties, you're sitting on a database worth millions to cybercriminals.

The real estate and property management industry has become a prime target because most firms handle high-value data with mid-tier security infrastructure. You're juggling tenant portals, maintenance requests, lease agreements, and financial transactions, often across multiple platforms that weren't designed to work together. That fragmentation creates vulnerabilities.

Why Property Management Firms Are in the Crosshairs

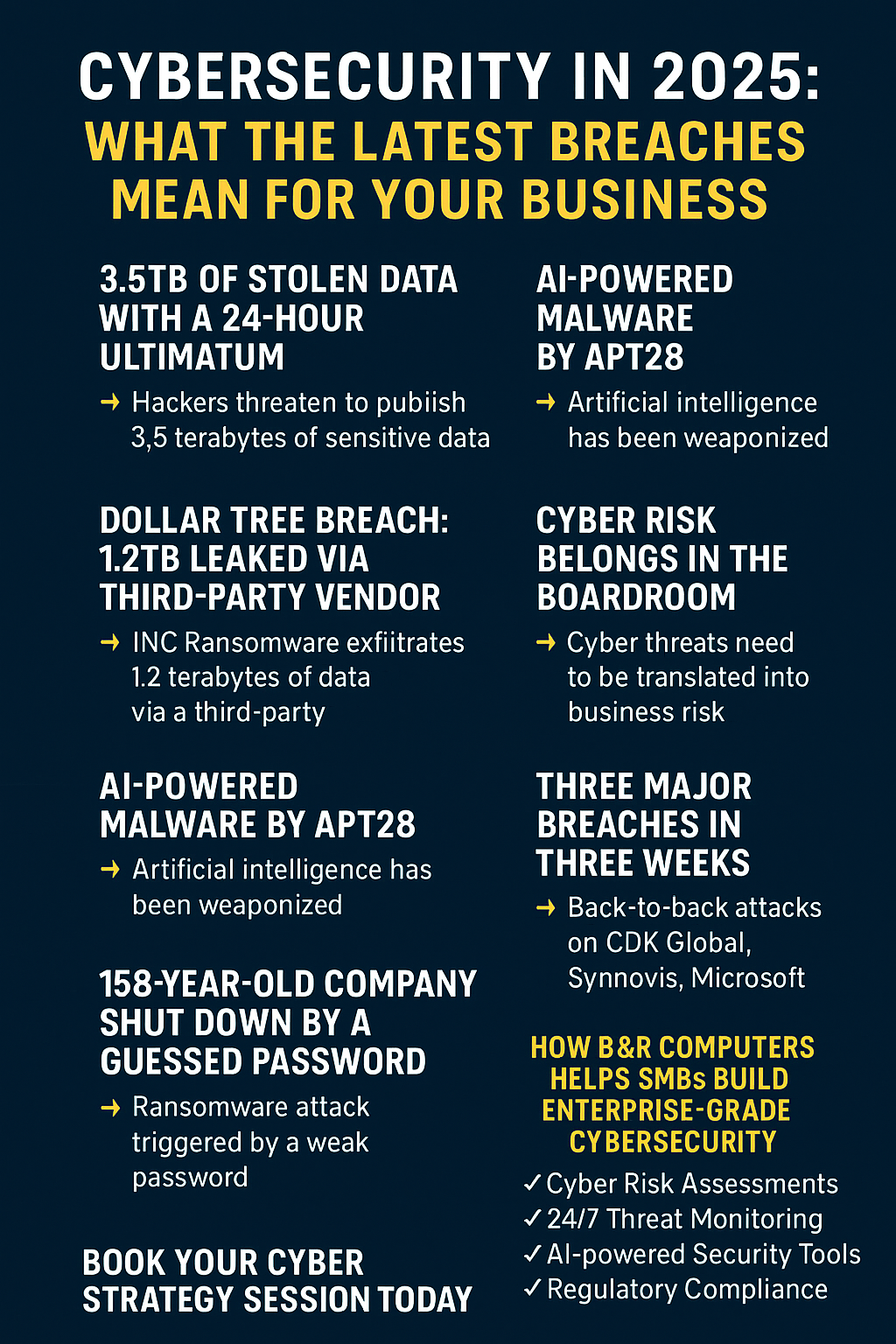

Hackers target property management companies for three reasons: valuable data, weak defenses, and high-dollar wire transfers.

First, the data. A single tenant file contains everything needed for identity theft. Multiply that by dozens or hundreds of units, and you're managing more sensitive information than many small banks. The difference? Banks have entire security teams. You probably have one IT person, or an outsourced provider who's stretched thin.

Second, the infrastructure. Many property management firms cobble together their tech stack over time: an older accounting system, a newer tenant portal, spreadsheets for maintenance tracking, and email for everything else. Each connection point is a potential entry for attackers. When systems don't communicate securely, data gets exposed during transfers.

Third, the money. Property managers regularly facilitate large wire transfers for earnest money, security deposits, and rent payments. Business Email Compromise (BEC) attacks have become frighteningly effective in real estate transactions. An attacker compromises an email account, monitors conversations, and at the critical moment, sends fraudulent wire instructions that look completely legitimate.

According to industry reports, cyberattacks on real estate data increased significantly in recent years, with smaller firms disproportionately affected. When 30% of real estate firms report a cybersecurity incident within a two-year period, this isn't a theoretical risk, it's a business reality.

The Business Email Compromise Threat

BEC attacks deserve special attention because they're devastatingly effective in property management. Here's how they work:

A hacker gains access to an email account, often through a phishing link or weak password. They sit quietly, reading emails and learning your processes. They identify upcoming transactions: a new tenant's security deposit, a property purchase closing, or a large maintenance payment.

At the right moment, they send an email that looks identical to your usual communications. "Quick update, our bank changed accounts. Please use these new wire instructions." The email comes from a legitimate-looking address, uses your typical language, and arrives at exactly the right time in the conversation.

The recipient sends the wire. By the time anyone realizes what happened, the money is gone.

This happens more often than you think. Real estate wire fraud has surged because the payoffs are enormous and the attacks are relatively simple to execute. A compromised email account can lead to losses in the hundreds of thousands of dollars.

Common Vulnerabilities in Property Management Systems

Most property management security failures stem from a few predictable weaknesses:

Shared login credentials. When multiple staff members use the same login for your property management software, you can't track who accessed what data or when. If that password gets compromised, you won't know which employee's device or behavior caused the breach.

Weak or reused passwords. "PortlandPM2020" might feel secure, but if an employee uses variations of that password across multiple platforms, a breach at one site compromises them all.

Unsecured document sharing. Emailing tenant applications as PDF attachments or using consumer-grade file sharing services exposes sensitive data during transmission. If those emails get intercepted or an employee's personal account gets hacked, tenant information is compromised.

Outdated software. That property management platform you've used for eight years? It probably has unpatched vulnerabilities. Software companies regularly release security updates to fix newly discovered flaws. When you don't update, you're leaving doors unlocked.

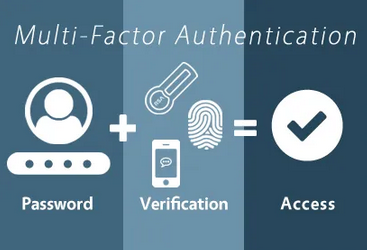

No multi-factor authentication. Email accounts and property management systems protected only by passwords are low-hanging fruit for hackers. If someone steals or guesses the password, they're in.

Inadequate access controls. Does your maintenance coordinator need access to tenant Social Security numbers? Does your leasing agent need banking information for all properties? When everyone has access to everything, a single compromised account exposes your entire database.

Practical Steps to Secure Tenant Data

The good news: you don't need an enterprise security budget to significantly reduce your risk. Focus on these high-impact measures:

Implement strict multi-factor authentication everywhere. Every email account, property management system, and financial platform should require MFA. This single step blocks the vast majority of account takeover attempts. Yes, it adds five seconds to login. It also prevents five-figure losses.

Use encrypted portals for document collection. Stop emailing tenant applications and bank statements. Secure portals encrypt data during transmission and storage. Many property management platforms include these features: you just need to enable and enforce their use.

Establish role-based access controls. Limit what each staff member can see based on what they actually need for their job. Your maintenance team doesn't need access to financial records. Your accountant doesn't need tenant Social Security numbers for routine reporting.

Create unique passwords and store them properly. Every staff member should use a password manager to generate and store unique passwords for each platform. This eliminates password reuse and weak passwords without making anyone memorize dozens of complex strings.

Verify all wire transfer instructions through a secondary channel. If you receive new wiring instructions via email, call the person at a known phone number (not one provided in the email) to confirm before processing. This simple step prevents most BEC fraud.

Conduct regular vulnerability scans. You need to know where your weaknesses are before hackers find them. Quarterly vulnerability assessments identify outdated software, misconfigured systems, and potential entry points.

Train your team on phishing recognition. Your staff is your first line of defense. Regular training helps them spot suspicious emails, understand the consequences of clicking malicious links, and know what to do when they receive something questionable.

Keep all software updated. Set automatic updates where possible. For systems requiring manual updates, establish a monthly review schedule. Every unpatched vulnerability is an invitation to hackers who scan for exactly these weaknesses.

Implement email security protocols. DMARC, SPF, and DKIM configurations help prevent email spoofing: making it much harder for attackers to impersonate your domain in phishing attacks against tenants or partners.

Establish a data retention and disposal policy. You don't need to keep every tenant application forever. Establish clear timelines for data deletion and ensure hard drives, paper files, and backup systems are securely destroyed when no longer needed.

The Cost of Doing Nothing

Data breaches average nearly $5 million in costs when you factor in forensic investigation, legal fees, notification requirements, credit monitoring for affected individuals, and regulatory fines. For property management firms, there's also the operational disruption: you can't rent properties or collect rent while your systems are down and you're rebuilding from backups.

Beyond the immediate costs, breaches destroy tenant trust. In a competitive rental market, prospective tenants research property managers online. A data breach becomes permanent public record. When tenants choose between your properties and a competitor's, that breach is a factor.

Regulatory penalties add another layer. Depending on your location and the nature of the breach, you may face fines under state data breach notification laws, housing regulations, or consumer protection statutes. These aren't minor: violations can reach six figures for significant breaches affecting hundreds of tenants.

Moving Forward

Property management security doesn't require a complete infrastructure overhaul. Start with MFA and encrypted document portals this month. Add vulnerability scanning next quarter. Build from there.

The businesses that get breached aren't necessarily doing everything wrong. They're usually doing most things right but have one or two critical gaps. Hackers only need one weakness to exploit. Your job is to eliminate the obvious ones before they do.

B&R Computers helps property managers secure their digital assets so they can focus on managing their portfolios without the threat of a data breach. If you're not sure where your vulnerabilities are or need help implementing these security measures, let's talk. We'll identify your specific risks and build a practical security plan that fits your operation.

Your tenants trust you with their most sensitive information. That trust comes with responsibility: and that responsibility starts with taking security seriously.