The FTC has made its position clear: if you handle consumer financial data, the Gramm-Leach-Bliley Act applies to you. Not just to the big banks. Not just to publicly traded financial institutions. To you: the mortgage broker with a team of five. The non-bank lender operating out of a single office. The tax preparation firm processing sensitive client information every quarter.

Yet despite the regulatory clarity, non-compliance remains rampant among small and mid-sized financial firms. The reason is simple: most assume the rules don't apply to them until an enforcement action proves otherwise.

The Dangerous Assumption: "We're Too Small to Matter"

Walk into any small mortgage brokerage or independent lending firm and ask about GLBA compliance. You'll likely hear some version of: "That's for the big guys. We don't have the kind of data that makes us a target."

This assumption is catastrophically wrong.

The FTC's Safeguards Rule doesn't distinguish between a multinational bank and a five-person financial advisory firm. If your business is "significantly engaged" in financial activities: lending, brokering, servicing loans, tax preparation, debt collection, or financial advising: you're covered. Period.

The rule applies to non-bank financial institutions, and the FTC interprets this broadly. Mortgage brokers, payday lenders, finance companies, account servicers, check cashers, wire transferors, collection agencies, credit counselors, tax preparation firms, and even automobile dealerships that extend credit fall under its jurisdiction.

The scale of your operation doesn't exempt you. The nature of your work does the opposite: it obligates you.

What the Safeguards Rule Actually Demands

The updated Safeguards Rule isn't a suggestion box. It's a prescriptive framework with ten core elements that financial institutions must implement and maintain. Here's what regulators expect to see:

A Designated Qualified Individual

Every covered institution must designate a single qualified individual responsible for overseeing the information security program. This person: whether internal staff or an outsourced expert: must have the authority and expertise to implement, monitor, and enforce security measures. They report directly to your board or governing body.

A Written Information Security Program

Your security program can't exist only in conversation. It must be documented, covering administrative, technical, and physical safeguards appropriate to your size, complexity, and the sensitivity of the data you handle.

Formal Risk Assessments

You must conduct periodic risk assessments that identify reasonably foreseeable internal and external threats to customer information. These assessments must evaluate the sufficiency of your current safeguards and be documented in writing.

Specific Technical Controls

The rule mandates access controls limiting who can view customer data, encryption for data in transit and at rest, multi-factor authentication for anyone accessing customer information, secure disposal procedures, and continuous monitoring of user activity. These aren't optional enhancements: they're baseline requirements.

Incident Response Planning

You need a written incident response plan that addresses how your organization will detect, respond to, and recover from security events. The plan must include procedures for notifying affected parties and regulators.

Regular Board Reporting

Your designated qualified individual must provide written reports to your board at least annually, covering the overall status of your information security program, compliance with the Safeguards Rule, and any material security events.

Third-Party Vendor Oversight

Here's where many firms stumble: you're responsible for ensuring your service providers maintain appropriate safeguards. If your cloud hosting provider suffers a breach exposing your clients' non-public personal information, regulators will ask what due diligence you performed before signing that contract.

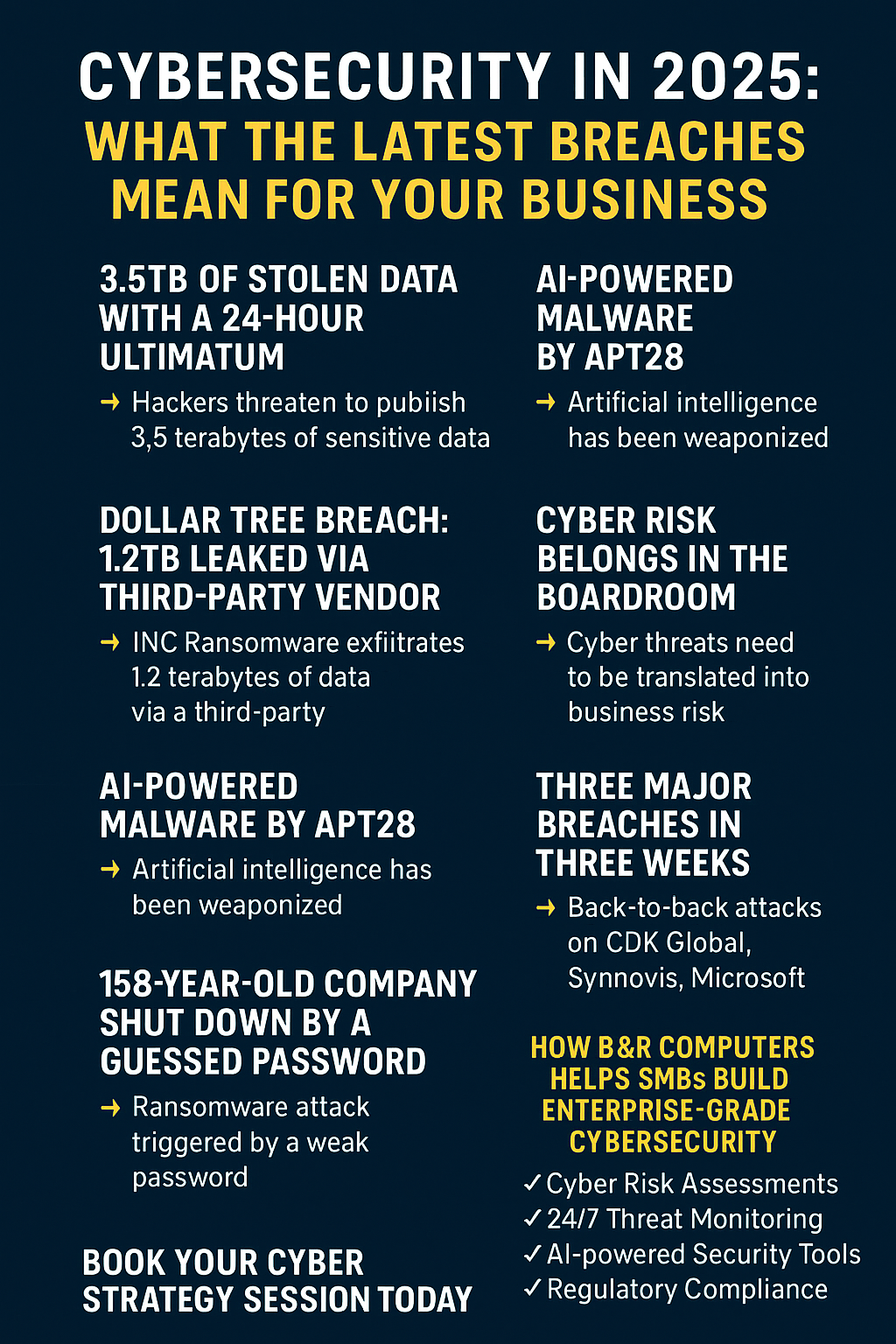

The Real Cost of Non-Compliance

The Safeguards Rule's penalty structure lacks the explicit fine schedules found in other regulations, which leads some firms to underestimate the risk. This is a mistake.

While the Privacy Rule specifies fines up to $100,000 per violation for institutions and $10,000 per violation for individuals, Safeguards Rule enforcement is examined case-by-case. The FTC has broad authority to pursue injunctive relief, consent orders, and monetary penalties that can devastate a small firm.

Beyond direct fines, consider the collateral damage:

Reputational Destruction

When the FTC announces an enforcement action, your firm's name becomes permanently associated with data protection failures. For financial services: where trust is the product: this association can be fatal to client retention and acquisition.

Operational Disruption

Consent orders typically require extensive remediation efforts, ongoing monitoring, and regular reporting to regulators. These obligations consume management attention and operational resources for years.

Personal Liability

Individual officers and directors can face personal liability for compliance failures. The designated qualified individual, in particular, carries significant accountability for program effectiveness.

Breach Notification Obligations

If you experience a security event affecting 500 or more consumers' unencrypted information, you must notify the FTC within 30 days. This notification triggers additional scrutiny and potential investigation.

The firms that treat GLBA compliance as a checkbox exercise: or ignore it entirely: are placing an enormous bet that they'll never experience a breach, never face an audit, and never attract regulatory attention. Given the current enforcement climate, that's not a bet worth taking.

Practical Steps to Close the Gap

Compliance doesn't require a seven-figure budget. It requires intentionality and consistent execution. Here's where to start:

Conduct a Formal Risk Assessment

If you haven't performed a documented risk assessment in the past twelve months, stop reading and schedule one. Identify where customer NPI lives in your systems, who has access, how it's protected, and what threats could compromise it. Document everything.

Encrypt Everything

Non-public personal information must be encrypted at rest and in transit. This isn't negotiable. If your customer data sits unencrypted on a file server or travels via unencrypted email, you're exposed.

Implement Multi-Factor Authentication

Every user accessing customer information needs MFA. This single control stops the majority of credential-based attacks that lead to data breaches.

Vet Your Vendors

Before signing contracts with any service provider that will touch customer data, assess their security posture. Request SOC 2 reports, review their security policies, and include contractual requirements for breach notification and security standards. Monitor their compliance continuously: not just at contract signing.

Document Your Incident Response Plan

Write down exactly what happens when something goes wrong. Who gets notified? What systems get isolated? How do you preserve evidence? Who communicates with affected clients? If the answer is "we'll figure it out when it happens," you're not compliant.

Designate Your Qualified Individual

Assign someone with actual security expertise to own this program. If you don't have that expertise in-house, outsource to a managed security provider who can serve in this role.

Train Your Team

Employees remain the primary attack vector for most breaches. Regular security awareness training isn't optional: it's a safeguard requirement.

The Path Forward

GLBA compliance isn't a one-time project. It's an ongoing operational commitment that requires continuous attention, regular assessment, and periodic updates as regulations evolve and threats change.

The firms that thrive under this regulatory framework are those that build compliance into their operational DNA rather than treating it as an annual audit exercise. They invest in proactive monitoring, maintain documented programs, and partner with security experts who understand both the technical requirements and the regulatory landscape.

B&R Computers works with financial firms: from independent mortgage brokers to regional lenders: to build and maintain GLBA-compliant security programs. Our managed security services include the continuous monitoring, risk assessments, and incident response capabilities that the Safeguards Rule demands. If you're uncertain about your current compliance posture, we should talk.

The FTC is paying attention. Your clients' data deserves protection. And the cost of getting this wrong far exceeds the investment required to get it right.