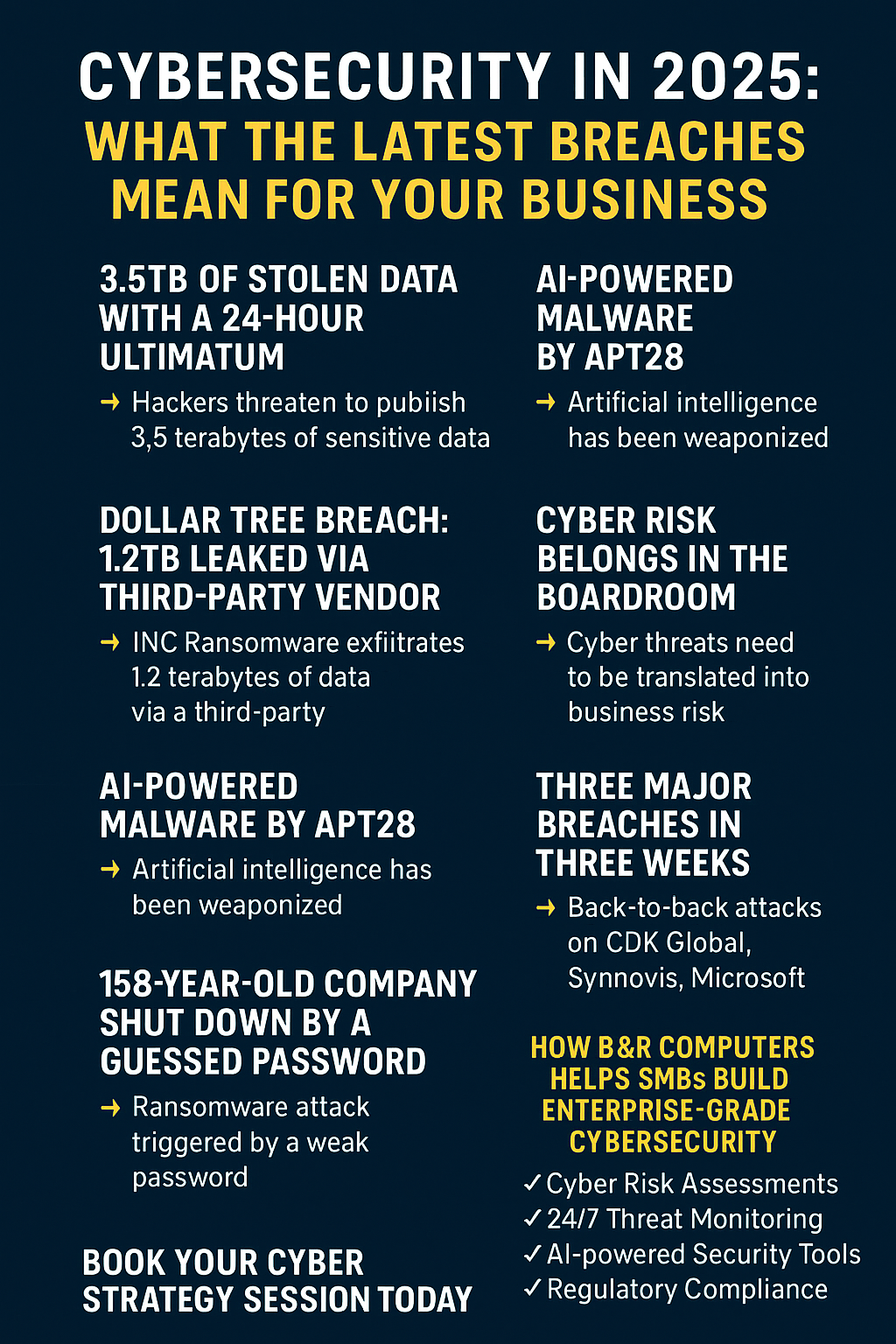

A buyer sits at their kitchen table, ready to close on their dream home. They receive an email from what appears to be their title company with updated wire instructions. They transfer $487,000. Within minutes, the money vanishes into an overseas account. They never see it again.

This scenario plays out thousands of times every year. Real estate wire fraud has exploded from $9 million in losses in 2015 to $446 million by 2022. The median loss per victim now exceeds $70,000: and that number keeps climbing.

If you work in real estate, property management, or any adjacent field, you are a target. Not might be. Are.

Why Real Estate Is Ground Zero for Wire Fraud

Real estate transactions check every box on a cybercriminal's wish list:

- High dollar amounts moving in single transfers

- Multiple parties (buyers, sellers, agents, title companies, lenders, attorneys) all exchanging sensitive information

- Time pressure that makes people skip verification steps

- Predictable processes that attackers can study and exploit

In Q1 of this year alone, 46.8% of real estate transactions contained fraud risk indicators. Nearly half. Each problematic transaction averaged a record 2.5 errors: meaning vulnerabilities are stacking up, not decreasing.

The FBI received 9,359 real estate fraud complaints last year, resulting in $173.6 million in reported losses. And that's just what gets reported.

How the Attack Actually Works

Business Email Compromise (BEC) is the weapon of choice. It accounted for $2.77 billion in losses across all sectors last year, making it one of the top three most financially damaging cybercrimes tracked by the FBI.

Here's how it unfolds in real estate:

Step 1: The Reconnaissance

Attackers don't work blindly. They research your company. They find out who handles closings. They monitor publicly available information about pending transactions: sometimes scraped from MLS listings, sometimes from compromised email accounts.

Step 2: The Compromise

The attacker gains access to an email account belonging to someone in the transaction chain. This could be the title company, the real estate agent, the attorney, or even the buyer themselves. Sometimes they use phishing. Sometimes they exploit weak passwords. Sometimes they buy credentials on the dark web.

Once inside, they sit and watch. They learn the communication patterns, the terminology, the timing.

Step 3: The Intercept

At the critical moment: usually right before closing: the attacker strikes. They send an email that looks identical to legitimate correspondence. Same signature block. Same formatting. Same tone. The only difference: the wire instructions point to their account.

Step 4: The Disappearance

Wire transfers are nearly instantaneous. Once the money hits the criminal's account, it gets moved: often through multiple hops across international borders: within hours. Recovery becomes a race against the clock that victims usually lose.

54% of real estate professionals encountered fraudulent seller impersonation attempts last year. 25% of homebuyers are targeted during closing. This isn't a rare occurrence. It's the norm.

The Damage Goes Beyond the Dollar Amount

Losing $500,000 is catastrophic enough. But the collateral damage extends further.

Reputation destruction. When a client loses their life savings on your watch, word spreads. Even if you weren't directly at fault, your name gets attached to the disaster. Trust: the foundation of real estate relationships: evaporates.

Legal exposure. Victims look for someone to blame. Lawsuits follow. Even if you prevail, the legal costs and time drain your resources.

Regulatory scrutiny. Depending on your state and the nature of your business, a wire fraud incident can trigger investigations and potential compliance violations.

Operational paralysis. After an incident, everything stops. You're dealing with law enforcement, insurance companies, attorneys, and traumatized clients instead of running your business.

The Verification Call That Could Save Everything

Here's the uncomfortable truth: most of these attacks succeed because someone skipped a simple step.

95% of title and escrow professionals report that wire fraud frequency has increased or remained steady. More than 60% of companies had been targeted in the past 12 months. The industry knows the threat exists. Yet the fraud keeps working.

Why? Because verification feels like friction. And in a fast-moving transaction, friction gets eliminated.

That mindset has to change.

Mandatory voice verification for any wire instruction change is non-negotiable. Not a callback to the number in the email. A call to a number you already have on file: one that was verified at the start of the relationship.

This single practice stops the majority of BEC attacks. The attacker can spoof an email address. They can't answer a phone number they don't control.

Practical Steps to Lock Down Your Transactions

Implement Multi-Factor Authentication Everywhere

Every email account. Every transaction management platform. Every system that touches client funds or sensitive data.

MFA isn't optional anymore. It's the baseline. If an attacker steals a password, MFA stops them from using it. This one control prevents the initial compromise that makes everything else possible.

If your team is still logging into email with just a password, you're leaving the door unlocked.

Establish a Written Wire Verification Policy

Don't leave verification to chance. Create a formal, written policy that specifies:

- Wire instructions will never be changed via email alone

- All wire changes require voice verification to a pre-established phone number

- Verification calls must be made by a different person than the one who received the email

- Document every verification call with date, time, and the name of the person contacted

Train every employee on this policy. Make compliance mandatory, not suggested.

Educate Your Clients Before They're Targeted

Your clients don't know what you know. They trust email. They don't understand how easy it is to spoof.

At the start of every transaction, tell them:

- "We will never change wire instructions via email."

- "If you receive wire instructions that look different from what we discussed, call us immediately at this number before sending anything."

- "When in doubt, verify. We will never be annoyed by a verification call."

Put this in writing. Include it in your initial paperwork. Repeat it at every milestone.

Monitor for Email Compromise Indicators

You can't stop what you can't see. Implement email security tools that detect:

- Login attempts from unusual locations

- Email forwarding rules added without authorization

- Replies going to different addresses than the original sender

- Domain spoofing (like using "bandrcomputers.co" instead of "bandrcomputers.com")

Early detection of a compromised account can stop an attack before the fraudulent wire instructions ever go out.

Know What to Do If It Happens

Speed matters. The FBI's Recovery Asset Team successfully froze or recovered 66% of attempted stolen funds last year: but only when victims reported immediately.

If you suspect wire fraud:

- Contact your bank immediately to attempt a recall

- File a complaint with the FBI's Internet Crime Complaint Center (IC3)

- Notify local law enforcement

- Preserve all evidence: emails, phone records, transaction logs

- Contact your cyber insurance carrier if you have coverage

Hours matter. Sometimes minutes.

The Industry Has to Get Serious

Wire-related errors appeared in 8.41% of transactions in Q1 of this year. CPL validation errors affected 47.7%. The infrastructure protecting real estate transactions has gaps: and attackers know exactly where they are.

Technology helps. Real-time verification systems, trusted data sets, and license validation checks can catch discrepancies before they become disasters. But technology alone isn't enough.

Human vigilance completes the picture. Every person in the transaction chain: from the listing agent to the closing coordinator to the buyer: has to understand the threat and take it seriously.

B&R Computers works with property management and real estate firms to secure their communications, implement proper access controls, and train their teams to recognize sophisticated phishing attacks. If you're not confident your current setup would stop a determined attacker, let's talk.