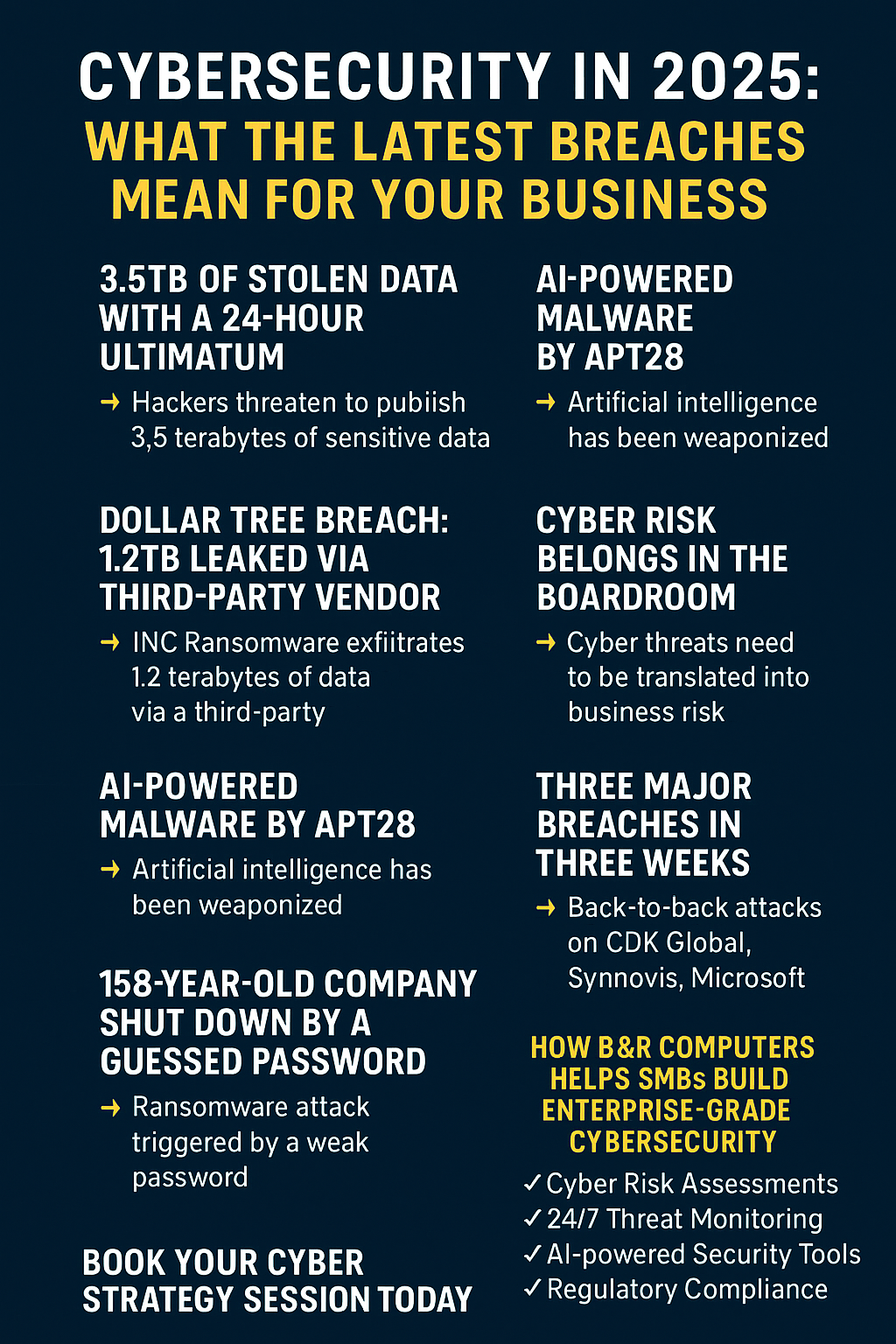

The numbers tell a stark story: 43% of small businesses experienced at least one cyber attack in the past 12 months, and 60% of those that suffer a breach go out of business within six months. Yet despite these alarming statistics, 59% of small business owners still operate without any cybersecurity measures, believing they're "too small to be targeted."

This dangerous misconception cost three real companies everything in recent months: and their stories reveal why 2026 has become the year every small business must take cybersecurity seriously.

The New Reality: Why Small Businesses Are Prime Targets

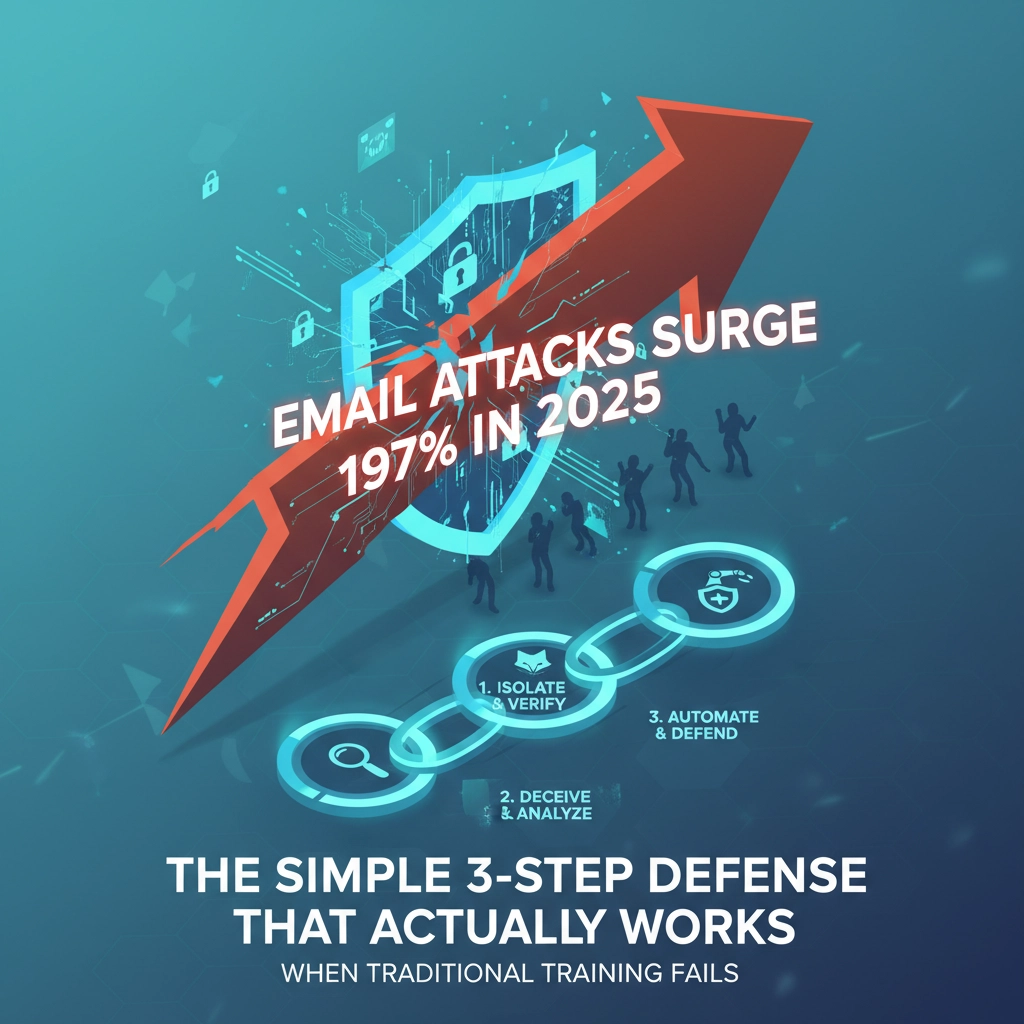

Cybercriminals have shifted their strategy. Instead of targeting large corporations with sophisticated defenses, they're focusing on the path of least resistance: small businesses. Small businesses now receive the highest rate of targeted malicious emails at one in 323, and employees face 350% more social engineering attacks than those at larger enterprises.

The reason is simple economics. Small businesses often hold valuable data: customer records, financial information, proprietary processes: but typically lack the security infrastructure of larger organizations. One-third of small businesses still rely on free, consumer-grade cybersecurity solutions, making them attractive targets for cybercriminals seeking quick wins.

Real Breaches, Real Consequences: Four Industry Examples

Healthcare Practice Data Exposure

A 15-person medical practice in Ohio discovered that patient records for over 8,000 individuals had been accessed through a compromised employee email account. The attack began with a seemingly legitimate email requesting verification of insurance information. The office manager, rushing between appointments, clicked the malicious link and entered credentials on a fake portal.

The damage: Beyond HIPAA violation fines totaling $180,000, the practice faced patient lawsuits and lost 40% of their patient base within three months. The practice ultimately closed after 20 years in business.

Tax Preparation Firm Credential Theft

A regional tax preparation firm serving 3,500 clients fell victim to a credential harvesting attack during peak tax season. Cybercriminals sent emails appearing to come from the IRS, requesting urgent verification of professional tax preparer credentials. Multiple employees across different locations clicked the links and entered their login information.

The impact: Criminals accessed client Social Security numbers, financial data, and tax returns for over 2,000 clients. The firm faced regulatory sanctions, client lawsuits, and a $340,000 recovery cost that forced them to sell to a larger competitor.

Property Management Company Supply Chain Attack

A property management company managing 450 rental units experienced a breach through their accounting software vendor. The software company had been compromised months earlier, and attackers used this access to deploy malicious updates that captured login credentials from all connected property management firms.

The consequences: Tenant personal information, rental payment data, and property access codes were stolen. The company spent $125,000 on notification costs, credit monitoring, and legal fees. They lost management contracts for 180 units as property owners moved to competitors.

Financial Advisory Firm Email Takeover

A 12-person financial advisory firm experienced a business email compromise after an employee's Office 365 account was accessed through recycled credentials from an unrelated data breach. The attackers monitored emails for three weeks before launching wire transfer requests to clients.

The fallout: While the firm caught the fraudulent transfers before money was stolen, client trust was shattered. Regulatory scrutiny intensified, and the firm lost $2.3 million in assets under management as clients moved to other advisors.

The Common Threads: What These Breaches Teach Us

Analyzing these real incidents reveals patterns that every small business can learn from:

Human error remains the weakest link. In each case, the breach started with an employee making a seemingly small mistake: clicking a link, entering credentials, or failing to verify a request. Phishing accounts for 33.8% of all breaches against small businesses, and these attacks are becoming increasingly sophisticated.

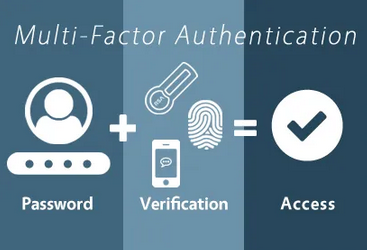

Basic security measures were missing. None of these businesses had implemented multi-factor authentication across all systems. This single security control could have prevented or significantly limited the damage in each case, yet only 20% of small businesses currently use MFA.

Recovery costs far exceeded prevention costs. Each business spent between $120,000 and $340,000 on recovery: amounts that would have funded comprehensive cybersecurity programs for years.

Trust is the hardest asset to rebuild. Beyond immediate financial losses, each business struggled with long-term reputation damage and client defection.

The Numbers Don't Lie: Small Business Vulnerabilities

Current statistics reveal the scope of small business cyber risk:

- 80% of all hacking incidents involve compromised credentials or passwords

- Only 17% of small businesses encrypt their data

- 87% of small businesses hold customer data that could be compromised

- 30% of ransomware attacks occur through compromised credentials

- Organizations now suffer an average of 1,308 cyber attacks per week

These numbers aren't abstract: they represent real businesses facing real threats every day.

Three Actions You Can Take Today to Protect Your Business

Based on the lessons from these real breaches, here are three immediate steps every small business should implement:

1. Deploy Multi-Factor Authentication Everywhere

What to do: Enable MFA on all business accounts: email, banking, cloud storage, accounting software, and any system containing sensitive data. Use authenticator apps rather than SMS when possible.

Why it matters: MFA would have prevented or limited the damage in all four breach examples above. Since 80% of hacking incidents involve compromised credentials, this single control dramatically reduces your risk.

Implementation tip: Start with your most critical systems (email and banking) and work your way down. Most cloud services now offer simple MFA setup that takes less than five minutes per account.

2. Create and Test an Incident Response Plan

What to do: Develop a written plan that outlines exactly what to do when a security incident occurs. Include who to contact, how to preserve evidence, when to notify customers, and how to communicate with law enforcement.

Why it's critical: None of the businesses in our examples had clear incident response procedures. This led to delayed reactions, poor decision-making under pressure, and higher recovery costs.

Key components: Your plan should include contact information for cybersecurity experts, legal counsel, cyber insurance carriers, and relevant regulatory bodies. Practice the plan quarterly with tabletop exercises.

3. Implement Employee Security Training with Regular Testing

What to do: Conduct monthly security awareness training focused on current threats. Include simulated phishing tests to identify vulnerabilities and provide additional training for employees who fall for tests.

The reality check: In each breach example, employee training could have prevented the initial compromise. Given that employees face 350% more social engineering attacks than those at larger companies, regular training isn't optional: it's essential.

Best practices: Make training relevant to your industry. Healthcare practices should focus on HIPAA-compliant email handling, while financial firms should emphasize wire transfer verification procedures.

The Cost of Inaction vs. Investment in Security

Consider the mathematics: The average small business cyber attack costs $120,000 to recover from, while comprehensive cybersecurity measures typically cost $2,000-$5,000 annually for a small business. Yet 63% of small businesses are increasing their cybersecurity spending this year, recognizing that prevention costs far less than recovery.

The businesses in our examples learned this lesson too late. Don't let yours become another cautionary tale.

Moving Forward: Building Cyber Resilience

Cybersecurity isn't a one-time project: it's an ongoing business process that requires regular attention and investment. The threat landscape continues evolving, with attackers developing new techniques and small businesses remaining primary targets.

The good news? You don't need enterprise-level budgets to implement effective security controls. The three actions outlined above: MFA, incident response planning, and employee training: form the foundation of cyber resilience and can be implemented immediately.

Ready to assess your cybersecurity posture? B&R Computers specializes in helping small businesses implement practical, cost-effective security solutions. Our cybersecurity assessments identify vulnerabilities specific to your industry and provide actionable recommendations that fit your budget. Contact us today to schedule a consultation and ensure your business doesn't become the next cautionary tale.

Remember: In cybersecurity, the question isn't whether you'll face an attack: it's whether you'll be prepared when it happens.