It started like any other Tuesday morning at Henderson Tax Services. Sarah, the office manager, opened what appeared to be an urgent email from their accounting software provider about a "critical security update." The email looked legitimate: correct logo, professional formatting, even a realistic sender address. She clicked the link, entered her credentials on what seemed like the familiar login page, and went about her day.

Three weeks later, $187,000 had vanished from their client trust account.

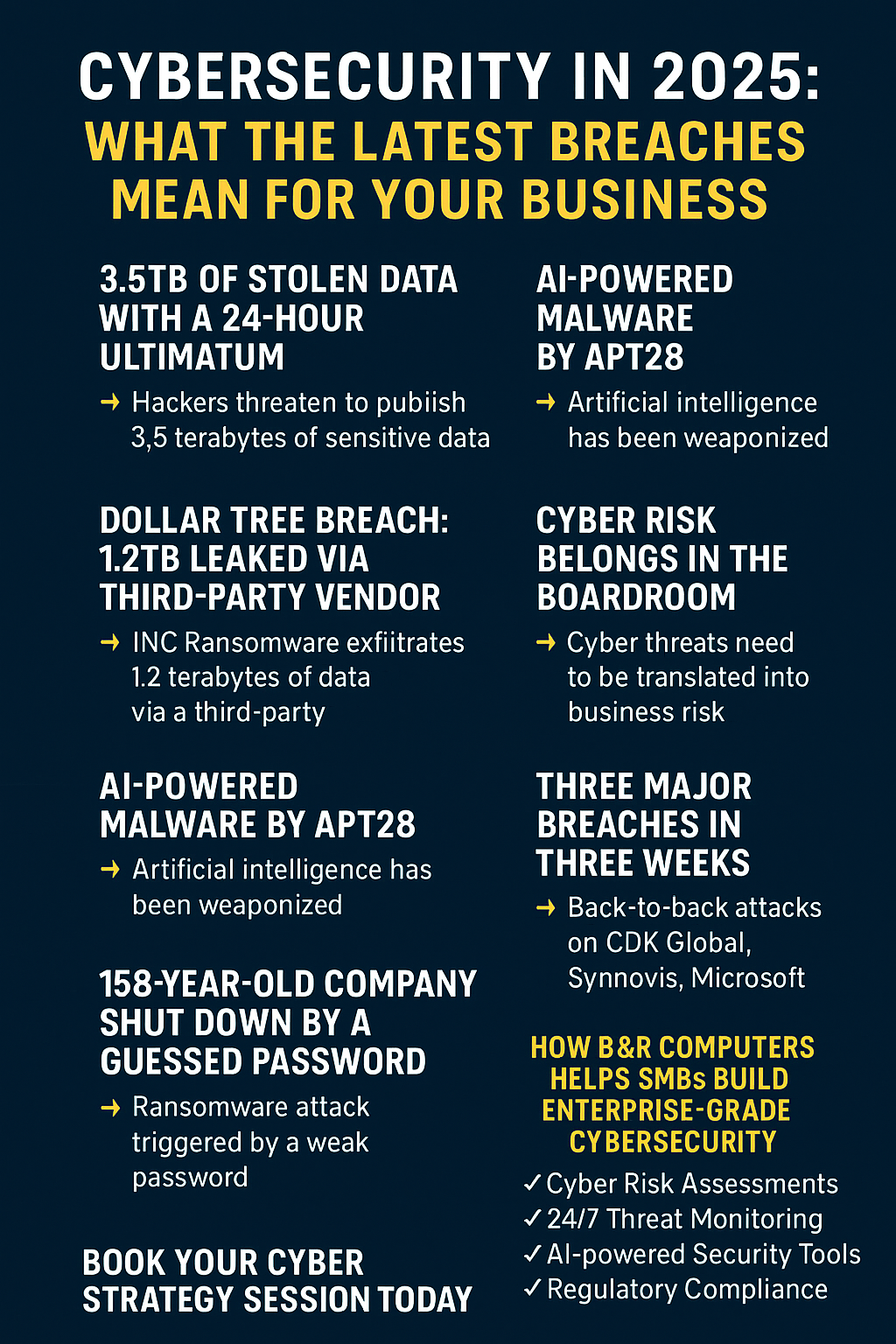

This isn't a hypothetical scenario: it's the reality facing small businesses across America in 2026. While the specific details above represent a composite of actual breach patterns we're seeing, the financial impact is all too real. Business Email Compromise (BEC) attacks now average $137,000 in losses per incident: an 83% increase from just five years ago.

The Sobering State of Email Security in 2026

The numbers paint a grim picture for small businesses. Despite representing smaller targets, SMBs account for 28% of all BEC victims. More alarming, 72.9% of these incidents begin with phishing emails: and attackers are getting more sophisticated every month.

Between September 2024 and February 2025 alone, phishing emails increased by 17.3%. Perhaps most concerning, 11.4% of these malicious messages now come from previously compromised accounts within trusted business networks, making them nearly impossible to detect with traditional email filters.

For small businesses, the consequences extend far beyond financial losses. When attacked, 75% of SMBs couldn't continue operating if hit with a successful breach, and nearly 40% lose crucial business data that may never be recoverable.

Industry-Specific Targets: Why Certain Sectors Face Higher Risk

Tax and Accounting Firms

Tax professionals handle treasure troves of sensitive financial data, making them prime targets during tax season. We're seeing attackers impersonate software providers like Intuit, Thomson Reuters, and Drake Software to steal login credentials. Once inside, criminals access client Social Security numbers, banking information, and financial records: data worth thousands on dark web markets.

Healthcare Clinics

Medical practices face a double threat: patient health records and insurance billing systems. Attackers often pose as medical billing companies or insurance providers, requesting "updated payment information" or "compliance verification." Small dental offices and family practices are particularly vulnerable because they typically lack dedicated IT support.

Property Management Companies

Real estate and property management firms handle large financial transactions and store extensive tenant data. Criminals frequently impersonate title companies, mortgage lenders, or inspection services to redirect wire transfers or steal deposit funds. A single compromised email account can expose dozens of property transactions.

Financial Advisory Firms

Investment advisors and financial planners manage client portfolios worth millions. Attackers target these firms with fake regulatory compliance notices from the SEC, FINRA, or state agencies, knowing advisors will act quickly to avoid violations. Once compromised, criminals can access investment accounts and client financial profiles.

How AI is Supercharging Email Threats

Traditional phishing emails contained obvious red flags: poor grammar, generic greetings, suspicious links. AI has eliminated these telltale signs. Modern attacks now feature:

Perfect Grammar and Syntax: AI writing tools create emails indistinguishable from legitimate business communications, eliminating the spelling errors that once helped recipients identify threats.

Personalized Content: Attackers use AI to scrape social media profiles, company websites, and public records to create highly targeted messages referencing specific employees, projects, or business relationships.

Dynamic Domain Generation: AI automatically creates convincing fake websites that mirror legitimate services, complete with functional login pages and realistic URLs that differ by just a character or two.

Voice and Video Deepfakes: Some attackers now combine email phishing with AI-generated phone calls or video conferences, using cloned voices of executives or vendors to add credibility to fraudulent requests.

Real-World Lessons from Recent Breaches

The "Trusted Vendor" Trap

A small CPA firm in Ohio received an email from their payroll processing company requesting updated bank account information for direct deposit changes. The email came from the vendor's actual domain (compromised in a previous attack), included the correct account representative's name, and referenced specific client details. The firm updated the information, and the next payroll run sent $89,000 to criminal accounts.

Lesson: Even emails from trusted sources require verification through separate communication channels.

The "Urgent Compliance" Scam

A financial advisory practice received what appeared to be a critical notice from their state securities regulator about immediate documentation requirements. Panicking about potential violations, the advisor quickly uploaded sensitive client files to the provided "secure portal": actually a data harvesting site operated by cybercriminals.

Lesson: Regulatory agencies don't request sensitive information via email. Always verify through official channels.

The "Supply Chain" Attack

A property management company's vendor portal was compromised, allowing criminals to send invoices and payment requests that appeared legitimate. Over three months, the company processed $156,000 in fraudulent payments before discovering the breach during a routine vendor audit.

Lesson: Implement verification procedures for all payment requests, regardless of source.

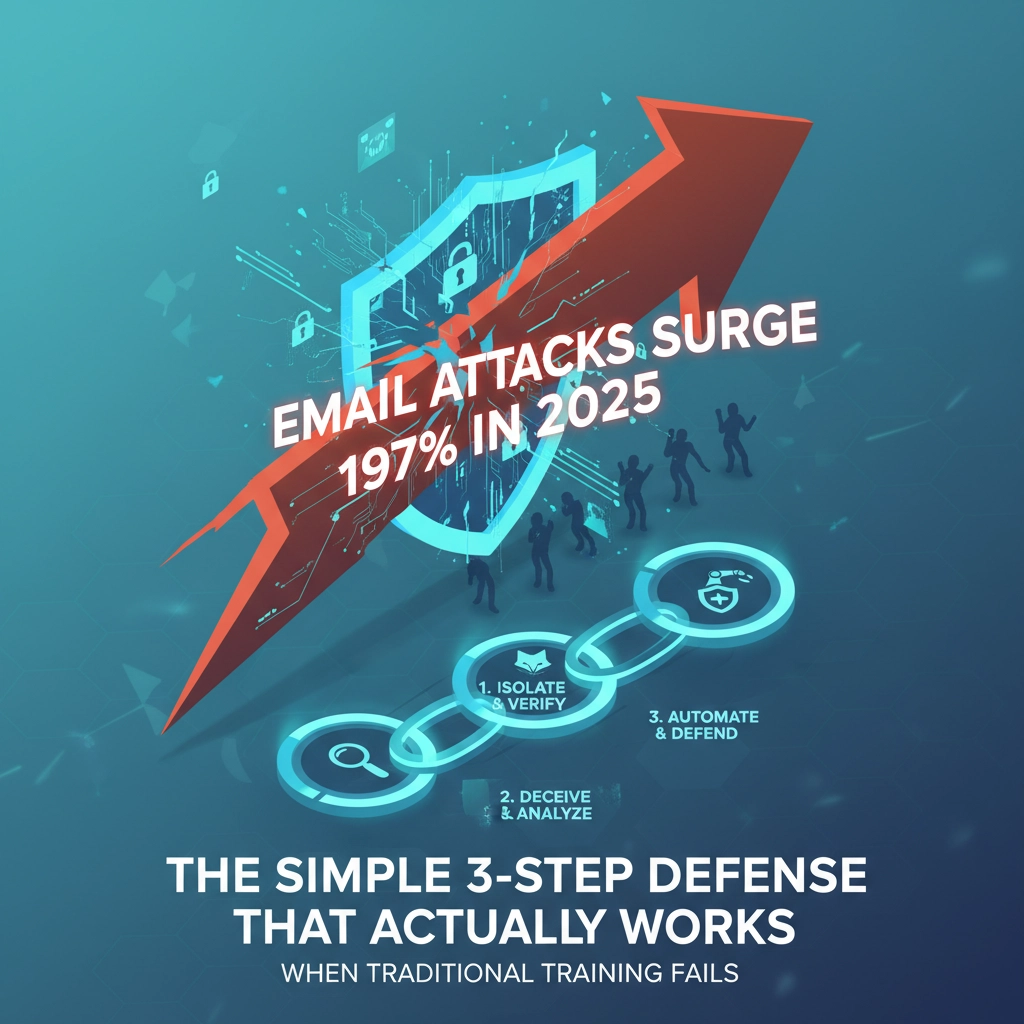

Three Practical Steps Every Small Business Can Take Today

1. Implement Multi-Factor Authentication (MFA) Everywhere

Enable MFA on all business email accounts, financial systems, and cloud applications. This single step would have prevented most of the breaches described above. Use authenticator apps rather than text messages when possible: SMS can be intercepted or redirected.

Quick Implementation: Start with your most critical accounts (email, banking, payroll) and work outward. Most systems now offer simple setup wizards that take less than five minutes per account.

2. Establish Verification Protocols for Financial Transactions

Create mandatory procedures requiring verbal confirmation for any payment requests or bank account changes, regardless of how they arrive. This includes wire transfers, ACH payments, and vendor information updates.

Sample Protocol: Any request to change payment information must be verified via phone call to a previously established number (not one provided in the email). Require two-person approval for wire transfers exceeding $5,000.

3. Conduct Regular "Phishing Drills" with Your Team

Don't wait for criminals to test your employees: do it yourself. Send simulated phishing emails monthly and provide immediate education when someone clicks. This creates a culture of security awareness that becomes second nature.

Simple Start: Use your email system's built-in tools or free services like KnowBe4's basic training to send test emails. Focus on education, not punishment: the goal is building security habits.

The Cost of Inaction

Only 17% of small businesses carry cyber insurance, and 27% of those handling credit card data have no cybersecurity protections whatsoever. Meanwhile, employees at small businesses face 350% more social engineering attacks than their counterparts at larger companies.

The mathematical reality is stark: with phishing emails targeting small businesses at a rate of one in 323 messages, it's not a matter of if your business will be targeted: it's when.

The good news? Most email-based attacks can be stopped with proper preparation and the right security mindset. The businesses that get compromised aren't necessarily doing everything wrong: they're just missing one or two critical protections that criminals know how to exploit.

Your Next Step

Don't wait until you become the next cautionary tale. The cybersecurity landscape changes daily, and what worked last year may not protect you today. A quick cyber risk assessment can identify your most vulnerable points and provide specific recommendations tailored to your business type and size.

At B&R Computers, we specialize in practical cybersecurity solutions for small businesses: no corporate-level complexity or budget-breaking costs. Our cyber risk assessments take less than an hour and provide clear, actionable steps to protect your business from email-based threats and other common attack vectors.

Contact us today to schedule your assessment and take the first step toward protecting your business from becoming another breach statistic.