If you're handling tax returns, managing books, or providing any kind of financial services, there's a federal rule you absolutely need to know about: and it's been getting more attention from regulators lately. The FTC Safeguards Rule isn't just another piece of bureaucratic red tape. It's actually a practical framework that helps you protect your clients' most sensitive information while keeping your practice legally compliant.

Here's the thing: whether you're a solo tax preparer working from your home office or part of a multi-partner CPA firm, this rule applies to you. And the good news? It's not as overwhelming as it might sound once you understand what's really required.

Who This Rule Actually Covers (Spoiler: It's Probably You)

The Safeguards Rule casts a pretty wide net. If you prepare tax returns, manage financial records, or provide financial planning services, you're considered a "financial institution" under the Gramm-Leach-Bliley Act. Size doesn't matter here: solo practitioners and large firms are held to the same standard.

What matters is the type of information you handle: tax returns, bank statements, Social Security numbers, financial records, client addresses, and basically any other sensitive financial data your clients trust you with. This includes information stored on your computer, in the cloud, in physical files, or even on backup drives sitting in your desk drawer.

Why This Matters Beyond Just "Following Rules"

Sure, compliance is important, but the Safeguards Rule actually serves your business in three major ways:

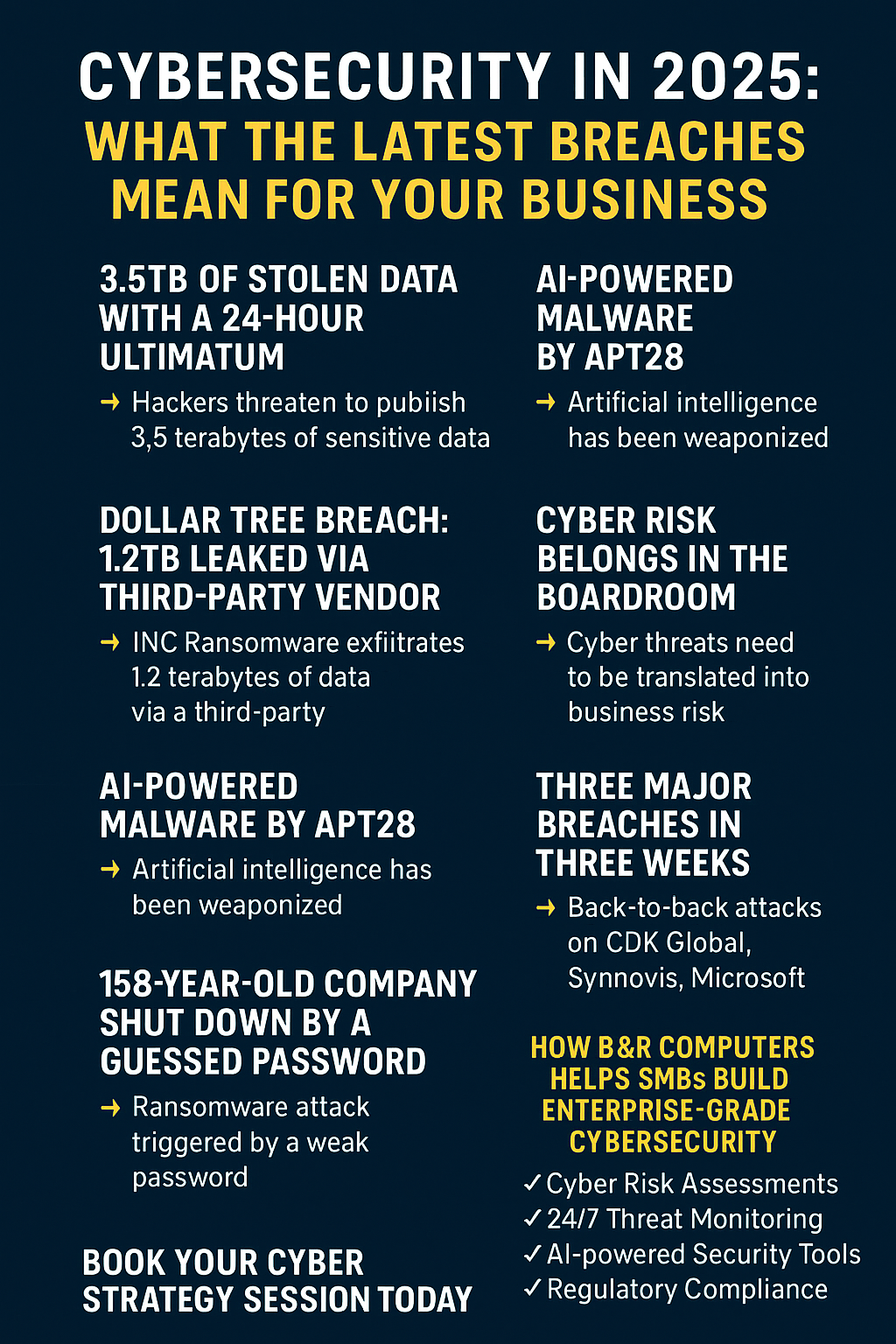

Client Trust: When clients know you take data security seriously, they're more likely to recommend you to others. In an age where data breaches make headlines regularly, being able to say "we follow federal security standards" is a real competitive advantage.

Business Protection: A data breach doesn't just hurt your clients: it can destroy your practice. The costs of breach notification, credit monitoring, legal fees, and lost business can be devastating for small firms.

Professional Standards: Following these guidelines demonstrates the same level of care and competence your clients expect from all your professional services.

The Nine Core Requirements (And What They Actually Mean)

The rule breaks down into nine essential elements. Don't worry: most of these are things you should be doing anyway, and they're more straightforward than they initially appear.

1. Designate Your Security Champion

You need someone responsible for your information security program. This could be you, a partner, or even an outside service provider. The key is that this person needs to understand cybersecurity basics and have the authority to implement security measures across your practice.

2. Document Your Risks

This means taking inventory of what client information you have, where it's stored, and what could threaten it. Think: laptops that could be stolen, email systems that could be hacked, or files that could be accessed by unauthorized people. Write it down and update it regularly.

3. Implement Multi-Factor Authentication

This is the "something you know, something you have" approach. Password plus text message code, password plus authenticator app, or password plus fingerprint. This single step stops the vast majority of unauthorized access attempts.

4. Encrypt Everything

Client data should be encrypted whether it's sitting on your hard drive or being sent over email. Most modern software does this automatically, but you need to verify it's actually happening.

5. Control and Monitor Access

Not everyone in your office needs access to all client files. Set up user permissions so people can only see what they need for their job, and keep logs of who accesses what.

6. Train Your Team

Regular training on recognizing phishing emails, using secure passwords, and following your security procedures. This doesn't have to be formal: even quarterly team meetings covering security basics count.

7. Have an Incident Response Plan

If something goes wrong, what's your plan? Who do you call? How do you contain the problem? How do you notify affected clients? Having this written down before you need it is crucial.

8. Vet Your Service Providers

Your cloud storage provider, email service, tax software company, and anyone else who might access client data needs to have appropriate security measures. Get this in writing in your contracts.

9. Keep Everything Updated

Security isn't a set-it-and-forget-it thing. Regular updates to software, periodic reviews of your procedures, and staying informed about new threats are all part of the ongoing process.

Small Firm Relief: The 5,000 Consumer Exception

Here's some good news: if your firm maintains information for fewer than 5,000 individual consumers, you may qualify for reduced requirements under certain provisions of the rule. A "consumer" here means individual clients who use your services for personal or family purposes (not business clients).

Even with this exception, the core security principles still apply: you just might have more flexibility in how you implement them.

Getting Started: Your First Steps

Feeling overwhelmed? Here's how to tackle this systematically:

Week 1: Inventory your client data. Where is it stored? How is it accessed? Who has access? Write it all down.

Week 2: Implement multi-factor authentication on all accounts that handle client data. Start with your email and tax software.

Week 3: Review your current security measures. What encryption do you already have? What access controls are in place?

Week 4: Create your written security plan. It doesn't have to be perfect: just document what you're doing and what you plan to improve.

The Bottom Line: This Is About Good Business, Not Just Compliance

The FTC Safeguards Rule might be a federal requirement, but think of it as a framework for running a more professional, trustworthy practice. Clients increasingly expect their financial professionals to take data security seriously, and these requirements help you meet those expectations systematically.

The rule also keeps pace with current technology and emerging threats, so your security measures need to evolve too. What was adequate five years ago might not be sufficient today, and what's adequate today might not be sufficient five years from now.

Remember, implementing these safeguards isn't just about avoiding penalties: it's about protecting the trust your clients place in you and ensuring your practice can thrive in an increasingly digital world.

Ready to Get Compliant Without the Headaches?

If tackling cybersecurity compliance feels like learning a foreign language, you're not alone. Many tax professionals and accounting practices find themselves caught between knowing they need better security and not knowing where to start.

That's where B&R Computers comes in. We help financial professionals like you implement FTC Safeguards Rule compliance without disrupting your day-to-day operations. From risk assessments to security training to ongoing monitoring, we make cybersecurity as straightforward as preparing a tax return.

Ready to protect your clients' data and your practice's reputation? Let's talk about creating a security plan that actually works for your business.