Let's be honest about something: most small businesses are approaching cyber insurance all wrong. You're paying premium prices for coverage while treating security requirements like annoying checkboxes to tick off. Meanwhile, cyber insurance premiums have jumped 50-100% in the past two years, and many insurers are flat-out refusing to cover businesses that don't meet their new standards.

Here's what's really happening behind the scenes. Insurance companies are now running vulnerability scans on your systems before they'll even quote you. They're requiring detailed IT questionnaires that would make your head spin. And they're using sophisticated risk assessment tools to determine exactly how likely your business is to file a claim.

But here's the thing – this isn't just about meeting minimum requirements anymore. The smartest business owners are figuring out that the right security moves don't just check compliance boxes; they actually slash your insurance costs while making your business genuinely safer.

The average data breach now costs $4.9 million. When you understand that number, you realize why insurers are desperate to work with businesses that demonstrate real risk reduction. They're not just looking for businesses that won't get hacked – they want partners who will minimize damage if something does happen.

The Premium Reduction Game Plan

Most business owners make a critical mistake when trying to negotiate better rates: they focus on technical jargon instead of financial impact. Insurance underwriters aren't cybersecurity experts. They're risk assessors who think in terms of claim probability and payout amounts.

When you implement the right controls and document them properly, you're speaking their language – quantifiable risk reduction that translates directly to lower premiums.

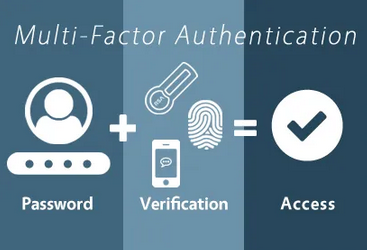

1. Multi-Factor Authentication: Your Instant Premium Reducer

This is the no-brainer that every business should implement immediately. Multi-Factor Authentication (MFA) requires users to verify their identity with two or more factors – typically a password plus a code sent to their phone.

Why insurers love it: MFA blocks 99.9% of automated attacks. It's simple, effective, and cheap to implement. Most importantly for your wallet, it's become a standard requirement for cyber insurance policies. Many insurers offer direct premium discounts for businesses that implement MFA across all systems.

The implementation is straightforward, but the impact on your risk profile is massive. Insurers view organizations without MFA as sitting ducks – businesses they simply don't want to insure at any reasonable rate.

2. Adopt a Recognized Cybersecurity Framework

Instead of cobbling together random security measures, implement a structured framework like NIST or ISO 27001. These frameworks provide comprehensive guidelines covering everything from access controls to incident response.

Why this matters to your premiums: When you can show insurers that your security program follows established standards, they see a mature, predictable risk profile rather than a business winging it with cybersecurity. This systematic approach signals that you're proactively managing threats according to proven methodologies, not just reacting to problems as they pop up.

3. Minimize Your Data Collection and Retention

Here's a strategy most businesses completely overlook: reduce the amount of sensitive information you store. The less personal information, payment data, or sensitive documents you retain, the smaller your breach risk becomes.

This means regularly purging obsolete data, archiving only what's necessary, and using techniques like tokenization or pseudonymization to protect what you do keep. Insurers recognize a simple truth – you can't lose what you don't have. Fewer data assets mean lower potential claim amounts.

When you can demonstrate that you're actively minimizing your data footprint, insurers see reduced exposure and often reward this with more favorable premiums.

4. Develop and Test an Incident Response Plan

Having a plan on paper isn't enough anymore. Insurers want to see documented, regularly tested incident response plans that prove everyone knows their role when something goes wrong.

Why this impacts your rates: Organizations with robust incident response capabilities typically face lower recovery costs when breaches occur. If you can show insurers recent tabletop exercises or simulations where you've tested your plan, you're demonstrating that even if a breach happens, you can contain it quickly and minimize damage.

This isn't just theoretical preparation – it's evidence that you'll be a lower-cost claim if something does happen.

5. Conduct Regular Penetration Testing

Running regular penetration tests lets you find vulnerabilities before attackers do. When you can present recent test results along with evidence of how you fixed discovered issues, insurers see a business actively managing its security posture.

The key here is the follow-through. Anyone can hire a penetration tester, but insurers want to see that you actually remediate the vulnerabilities they find. This proactive approach to vulnerability management demonstrates security maturity and reduces the likelihood of successful attacks.

6. Implement Comprehensive Employee Training

Human error remains one of the leading causes of breaches, and insurers know it. Regular, thorough cybersecurity training for all employees isn't just good practice – it's premium insurance.

Your training should cover phishing awareness, password hygiene, safe browsing practices, and incident reporting procedures. The critical part is making it measurable. Track completion rates, run simulated phishing exercises, and document the results. When insurers see that you're actively improving your human firewall, they factor that into your risk assessment.

7. Maintain Current Systems with Regular Updates

This might seem basic, but maintaining regular software updates and patches across all systems demonstrates operational discipline that insurers highly value. Unpatched systems are low-hanging fruit for cybercriminals, and organizations that fall behind on patching statistically suffer more breaches.

Document your patch management process, including timelines for critical security updates and any automated deployment systems you use. This shows underwriters that you're systematically closing known vulnerabilities rather than leaving obvious attack vectors open.

Document Everything and Work Smart

Here's where most businesses fail: they implement great security measures but don't document them properly for insurers. Maintain detailed records of all your cybersecurity initiatives, including implementation dates, test results, training completion rates, and continuous improvement efforts.

Consider working with a broker who specializes in cyber insurance. They understand how to position your security posture to underwriters and know which controls carry the most weight with different insurers. This expertise can be the difference between getting standard rates and securing significant discounts.

The Bottom Line on Premium Reduction

These aren't just compliance exercises – they're business investments that pay dividends in reduced insurance costs and improved security. When you approach cybersecurity strategically, you're not just meeting insurer requirements; you're building a genuinely more secure business while saving money on premiums.

The businesses that will thrive in this new landscape are those that view cybersecurity as a competitive advantage rather than a necessary evil. Start with the moves that have the biggest impact on both your security and your premiums, then build from there.

Ready to turn your cybersecurity investments into premium savings? At B&R Computers, we help small businesses implement these exact strategies while ensuring they're documented properly for maximum insurance benefit. Contact us today to discuss how we can help you build a security program that actually reduces your costs while keeping your business safe.