Picture this: Your morning coffee is still steaming when you check your business bank account, only to find thousands of dollars mysteriously transferred out overnight. No dramatic ransom note, no locked computers, no obvious signs of a cyberattack: just your money, gone. Welcome to the world of infostealers, the silent predators that are quietly decimating small business bank accounts across America in 2025.

While everyone's been talking about flashy ransomware attacks that make headlines, a more insidious threat has been growing in the shadows. Infostealers don't announce themselves with scary messages or encrypted files. Instead, they slip into your systems like digital pickpockets, quietly harvesting your most valuable information: passwords, banking credentials, financial data: and selling it to the highest bidder on the dark web.

What Exactly Are Infostealers?

Think of infostealers as the master thieves of the digital world. Unlike ransomware that kicks down your front door and demands money, infostealers are more like cat burglars who slip in through an unlocked window, photograph your safe combination, and leave without disturbing anything else. You might not even know they were there for months.

These malicious programs are specifically designed to harvest sensitive information from infected computers. They're after your:

- Login credentials for banking and financial accounts

- Saved passwords in web browsers

- Two-factor authentication codes

- Cryptocurrency wallet information

- Customer payment data

- Business financial records

The newest variants, like the recently discovered "FleshStealer," have become incredibly sophisticated. This particular strain targets web browsers, crypto wallets, and even two-factor authentication extensions while using advanced encryption and self-termination capabilities to avoid detection. It's like having a thief who not only steals your valuables but also erases all evidence they were ever in your house.

Why Small Businesses Are Sitting Ducks

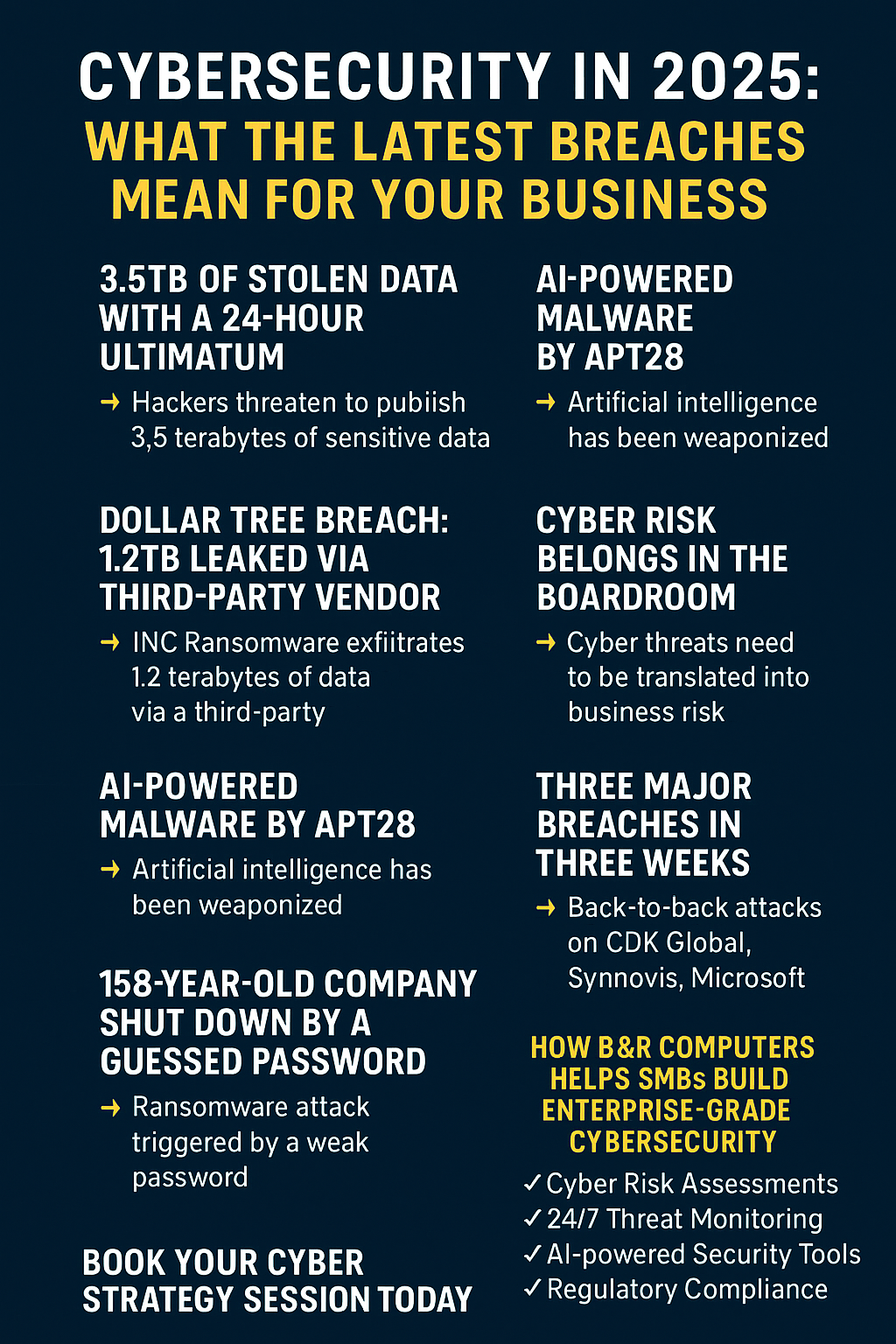

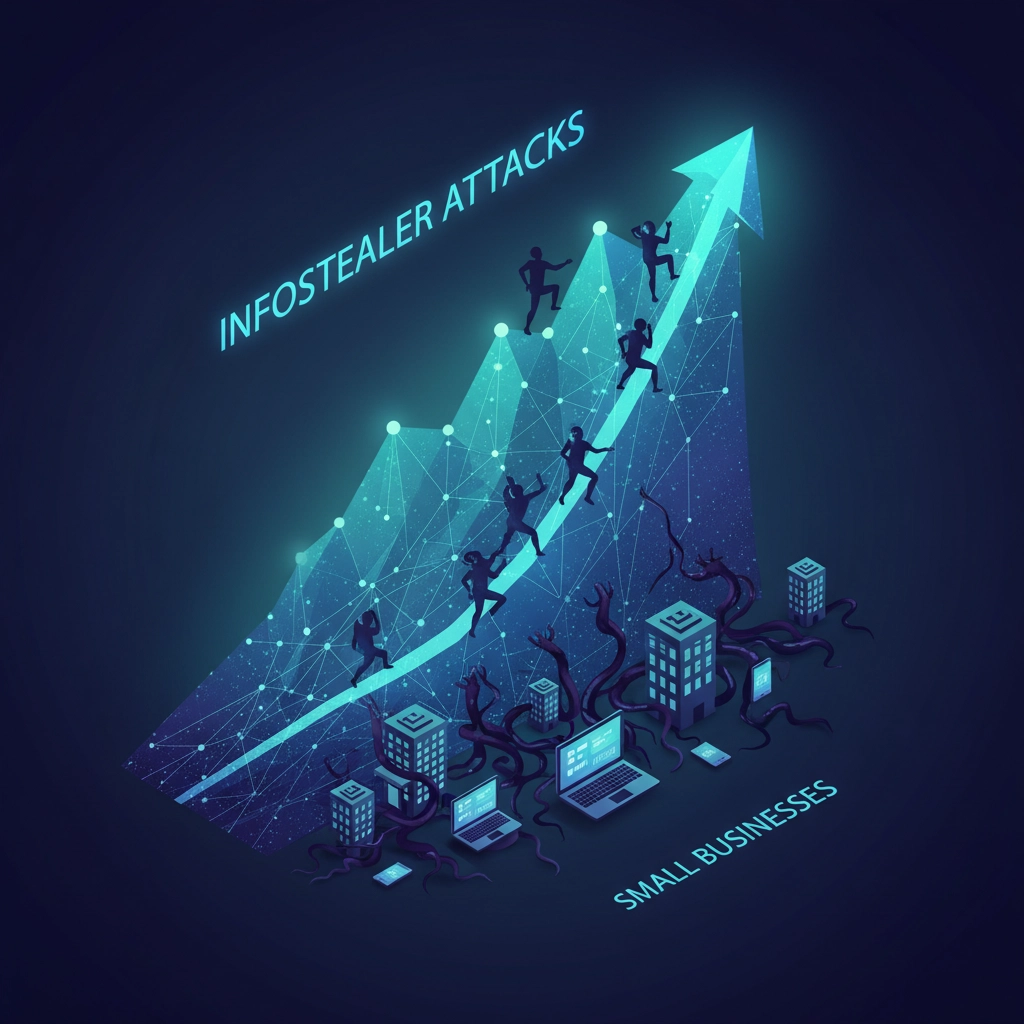

Here's the uncomfortable truth: if you're running a small business, you're not flying under the radar anymore. You're actually the preferred target. The 2025 Huntress Cyber Threat Report reveals some sobering statistics: infostealers have seen a 104% year-over-year increase in detections, and small and medium-sized businesses are getting hit the hardest.

Why? It comes down to resources. Large corporations have dedicated cybersecurity teams, advanced monitoring systems, and million-dollar security budgets. You've got Sarah from accounting who also handles IT when she has time, and a security budget that might cover a decent antivirus program if you're lucky.

The "bring your own device" policies that many small businesses love for their flexibility have created a massive vulnerability. Research shows that 46% of compromised systems were non-managed devices: those personal laptops and phones your employees use for both work and personal stuff. When an infostealer infects your employee's personal device, it doesn't just grab their personal Instagram password. It's also harvesting their work email credentials, access to your business banking portal, and anything else stored in their browser.

The Numbers Don't Lie: And They're Terrifying

Let's talk about the scale of this problem because the numbers are genuinely alarming. Infostealer activity has surged by 266% in recent years, and these attacks now account for nearly 24% of all cyber incidents. That's not a typo: almost one in four cyberattacks now involves infostealers.

Small business cyberattacks have nearly doubled in 2025, with 72% of small and medium businesses now facing cyber attacks. But here's what makes infostealers particularly devastating: unlike ransomware that hits you with an immediate, one-time demand, infostealers enable continuous financial drainage. Once criminals have your banking credentials, they can slowly siphon money over time, making smaller withdrawals that might not trigger immediate attention.

The financial impact goes beyond just direct theft. You're looking at:

- Direct financial losses from unauthorized transactions

- Operational downtime while you secure compromised systems

- Reputation damage when customers learn their data was compromised

- Regulatory fines and compliance costs

- The expense of forensic investigation and system remediation

- Lost business due to customer distrust

How These Digital Pickpockets Get In

Infostealers are getting distributed through increasingly clever methods that specifically target the way small businesses operate online. The main attack vectors include:

SEO Poisoning: Criminals create fake websites that show up in Google search results when you're looking for legitimate business software. Click on what looks like a normal download link, and you've just invited an infostealer into your network.

Malicious Google Ads: Even paid search results aren't safe. Cybercriminals buy ads for popular business software, redirecting unsuspecting small business owners to infected downloads.

Email Attachments: That innocent-looking PDF invoice or software update email might be carrying a digital parasite designed to steal your credentials.

Software Supply Chain Attacks: Sometimes the legitimate software you download has been compromised at the source, turning trusted applications into delivery mechanisms for malware.

The sophistication of these distribution methods is particularly effective against small businesses because they exploit the very tools and processes you rely on to run your operations efficiently.

The Dark Web Economy Fueling This Crisis

What makes the infostealer epidemic so persistent is the mature criminal economy that has developed around stolen credentials. There are now entire marketplaces on the dark web where your business banking information can be bought and sold like commodities. Telegram groups, automated shops, and specialized forums have made it incredibly easy for criminals to monetize stolen data almost instantly.

This economic infrastructure has transformed credential theft from a complex, high-skill operation into something that's accessible to relatively low-skilled cybercriminals. When there's a ready market for stolen business banking credentials, more criminals are motivated to deploy infostealers.

Protecting Your Business From the Silent Epidemic

The good news is that small businesses aren't completely helpless against infostealers. While you might not have the resources of a Fortune 500 company, you can implement practical defenses that significantly reduce your risk:

Employee Education: Train your team to recognize suspicious emails, avoid clicking on unknown links, and be skeptical of urgent download requests. Most infostealer infections start with human error.

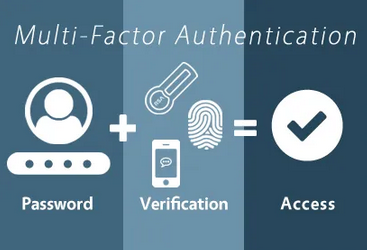

Multi-Factor Authentication: Add MFA to all business accounts, especially banking and financial services. Even if criminals steal your password, they'll still need that second authentication factor.

Endpoint Detection: Invest in endpoint detection and response tools that can identify suspicious behavior on devices connecting to your network. These systems can spot infostealers even when traditional antivirus software misses them.

Browser Hygiene: Configure business browsers to not save passwords, use dedicated browsers for banking activities, and regularly clear stored credentials.

Device Management: Implement policies for BYOD environments that require basic security measures on personal devices used for work.

Regular Security Assessments: Periodically audit your systems for signs of compromise and update your security measures based on current threats.

The Reality Check: You're Not Too Small to Matter

The old assumption that small businesses are "too small to hack" is not just outdated: it's dangerous. The data shows that cybercriminals have specifically shifted their focus to small businesses because they offer the perfect combination of valuable financial access and weaker defenses.

Your business banking account, customer payment data, and financial records are just as valuable to criminals as those belonging to larger companies. In some ways, they're more valuable because they're easier to access and less likely to be monitored by sophisticated security systems.

Take Action Before You Become a Statistic

The infostealer epidemic isn't slowing down: it's accelerating. Every day you delay implementing proper cybersecurity measures is another day your business remains vulnerable to having its financial accounts systematically drained by digital thieves.

Don't wait until you're checking your bank account over morning coffee only to discover that criminals have been quietly stealing from you for months. The time to act is now, while your accounts are still secure and your business data remains in your control.

At B&R Computers, we specialize in helping small businesses implement practical, cost-effective cybersecurity solutions that actually stop real-world attacks like infostealers. We understand that you don't need enterprise-level complexity: you need protection that works within your budget and doesn't interfere with running your business.

Contact us today to schedule a cybersecurity assessment and learn how we can help protect your business from the silent epidemic that's draining small business bank accounts across the country. Because in 2025, cybersecurity isn't optional( it's essential for survival.)