Picture this: Your CFO just got off the phone with your insurance broker, confidently telling you that your new cyber insurance policy will cover "most or all" losses from any cyberattack. Here's the problem: about 71% of CFOs at billion-dollar companies believe this exact same thing. And they're wrong.

Cyber insurance is one of the most misunderstood business policies out there. It's not your fault: the coverage is complex, the terminology is confusing, and frankly, many brokers don't fully understand it themselves. But getting this wrong could cost you millions when you need protection most.

Let's cut through the confusion and talk about what cyber insurance actually covers, what it doesn't, and the surprises that catch even savvy business owners off guard.

The Two-Part Protection System You Need to Understand

Cyber insurance works through two distinct coverage mechanisms that most people don't realize are separate: first-party coverage and third-party coverage.

First-party coverage handles the direct costs your business faces when something goes wrong. Think of it as covering what happens to you. Third-party coverage protects you from lawsuits and claims filed by others affected by incidents involving your systems. This covers what happens because of you.

This distinction matters because you might assume you're covered for everything, but you actually need both types to be properly protected.

What First-Party Coverage Actually Includes

When a cyber incident hits your business directly, first-party coverage steps in to handle the immediate financial damage. This includes:

Investigation and Legal Costs: Forensic services to figure out what happened, legal counsel to determine your notification obligations, and regulatory compliance expenses. These costs alone can easily hit six figures.

Data Recovery and System Restoration: Rebuilding corrupted files, restoring systems from backups, and getting your operations back online. The average cost for data recovery and restoration can exceed $270,000 per incident.

Business Interruption: Lost income when your systems are down, plus the extra expenses you incur to keep operating (like renting temporary equipment or paying overtime to staff).

Crisis Management: Public relations support, customer notification services, call center operations, and credit monitoring for affected customers.

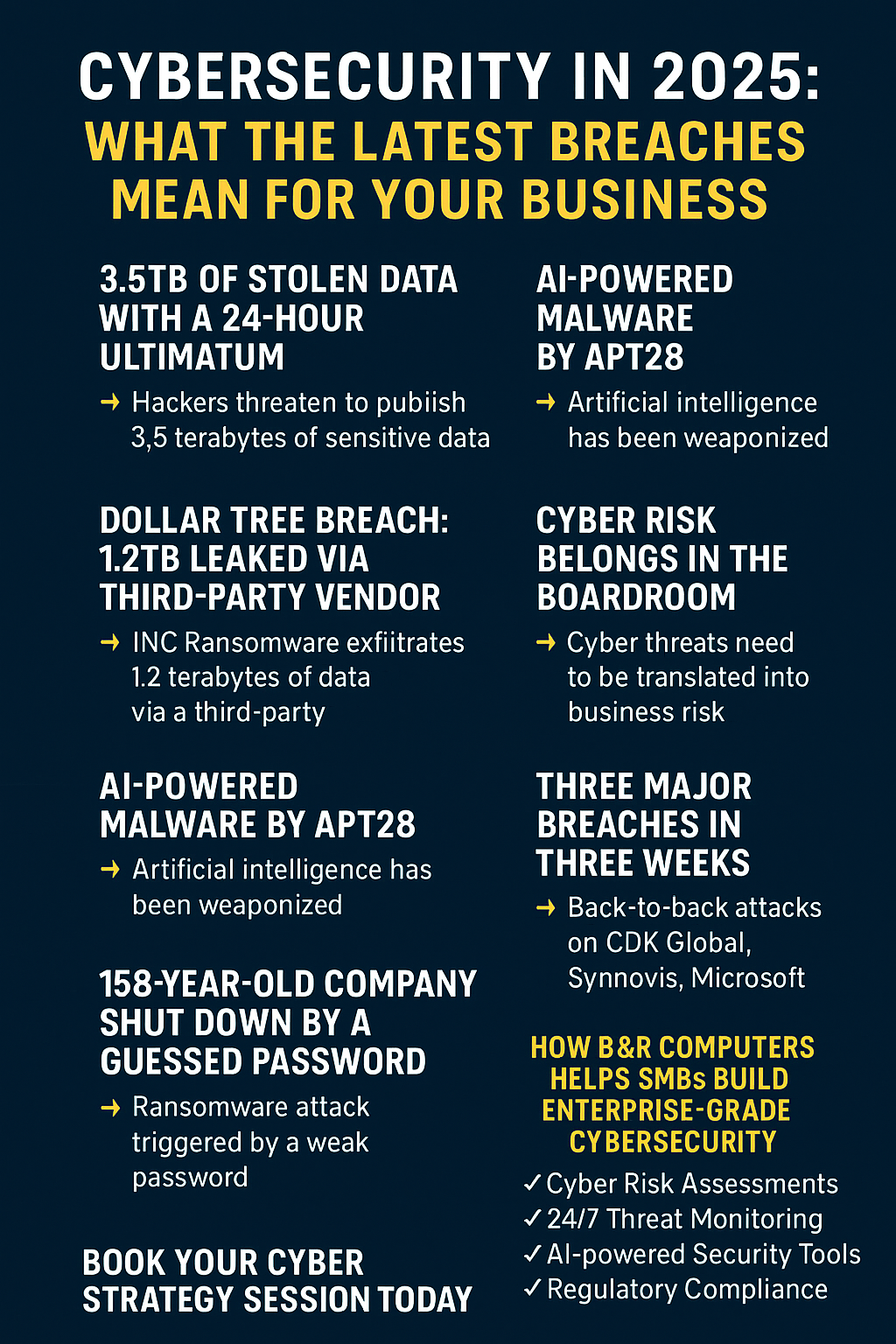

Cyber Extortion: Ransom payments and negotiation costs when hackers demand payment to unlock your systems or return your data.

Third-Party Coverage: When Others Come After You

If your data breach exposes customer information that leads to identity theft, or if your compromised systems are used to attack other businesses, third-party coverage handles the legal fallout. This includes lawsuit defense costs, settlements, damages claims, and regulatory fines imposed by government agencies.

Here's what many business owners don't realize: if customer data passes through your systems and gets compromised: even if the actual breach happens at a vendor: you could still face lawsuits from those customers.

The Five Coverage Types You Should Know About

Most cyber policies offer five distinct types of coverage. Understanding these helps you spot gaps in your protection:

-

Privacy Liability Coverage: Protects when you're handling sensitive customer or employee information. Covers privacy law violations, consumer class-action lawsuits, and regulatory penalties.

-

Network Security Coverage: Handles first-party costs from breaches, ransomware, malware infections, and business email compromise attacks.

-

Network Business Interruption: Covers lost profits and fixed expenses when system failures shut down your operations: whether from cyberattacks, human error, or failed software updates.

-

Errors and Omissions Coverage: Protects when cyber events prevent you from delivering services or fulfilling contracts.

-

Media Liability Coverage: Covers intellectual property infringement claims related to your online advertising and social media activities.

The Surprises That Catch Everyone Off Guard

Surprise #1: Human Error IS Usually Covered

One of the biggest myths floating around is that cyber insurance excludes human error. This isn't true for most modern policies. Coverage typically includes social engineering attacks (when employees are tricked into transferring money or data), accidental data disclosure, lost devices, rogue employee actions, and failed system updates.

The key is in the policy language: look for "system failure" or "administrative error" provisions that affirmatively cover accidental losses.

Surprise #2: You Might Have More Control Than You Think

Many insurers maintain panels of recommended legal counsel and incident response vendors, but here's what they don't always tell you: most are willing to work with your existing or preferred providers. Some policies even give you complete discretion in choosing your advisors. This is worth negotiating during policy selection.

Surprise #3: Geographic Coverage Can Be Broader Than Expected

Look for policies that cover incidents occurring anywhere in the world, not just in the United States. Many businesses assume they're only covered domestically, but global coverage is often available and increasingly necessary as remote work expands.

Surprise #4: The 24/7 Breach Hotline

A feature many policyholders don't know they have is immediate access to a breach response hotline available 24/7, 365 days a year. This expert guidance during the critical first hours after discovering a breach can be invaluable: and it's often included at no extra cost.

What Definitely ISN'T Covered (The Reality Check)

Now for the hard truths about what cyber insurance won't cover:

Reputation Damage and Brand Impact: The intangible but devastating consequences of cyber incidents: lost customer trust, damaged brand reputation, and decreased market share: are typically excluded.

System Improvements: Don't expect your insurer to pay for security upgrades or system enhancements. Insurance covers restoring what you had, not making it better.

Intentional Misconduct: Claims arising from deliberate wrongdoing or gross negligence often aren't covered.

Related Party Claims: Many policies exclude claims from employees or other related parties.

Indirect Business Losses: While direct losses are covered, the broader economic impact on your business often isn't.

What to Look for When Shopping for Coverage

When evaluating cyber insurance, prioritize these features:

Duty to Defend Language: This means your insurer will defend you in lawsuits or regulatory investigations, not just pay claims after the fact.

Vendor and Third-Party Coverage: Ensure incidents involving your vendors and business partners are covered.

Worldwide Coverage: Make sure protection extends beyond your home country.

Broad Definition of Personal Information: Look for policies that cover various types of sensitive data, not just traditional PII.

Pre-Breach Services: Some policies include risk assessments, employee training, and other preventive services.

The Bottom Line: It's a Parachute, Not a Shield

Here's the most important thing to understand: cyber insurance is a parachute, not a shield. It protects your balance sheet from costly incidents but cannot prevent cyberattacks from occurring in the first place.

The coverage gaps are real, and they're significant. Understanding both what your policy covers and what it explicitly excludes is essential for informed risk management.

Don't make the CFO mistake of assuming you're covered for "most or all" losses. Read your policy, ask specific questions, and work with professionals who truly understand cyber insurance complexities.

Ready to review your cyber insurance coverage or explore your options? At B&R Computers, we help businesses navigate the complex world of cybersecurity insurance and ensure your coverage matches your actual risk profile. Contact us today to schedule a consultation and get the protection your business really needs.