Picture this: Your finance director gets an urgent email from the CEO asking for a quick wire transfer to close a "confidential acquisition deal." The email looks legitimate, the tone sounds right, and the request seems reasonable. So they process the $50,000 transfer… only to discover later that the CEO was in a board meeting and never sent any email.

Welcome to the world of Business Email Compromise (BEC) attacks: the kind of cybercrime that doesn't need fancy malware or complex hacking. Instead, it weaponizes something far more dangerous: human trust and workplace hierarchy.

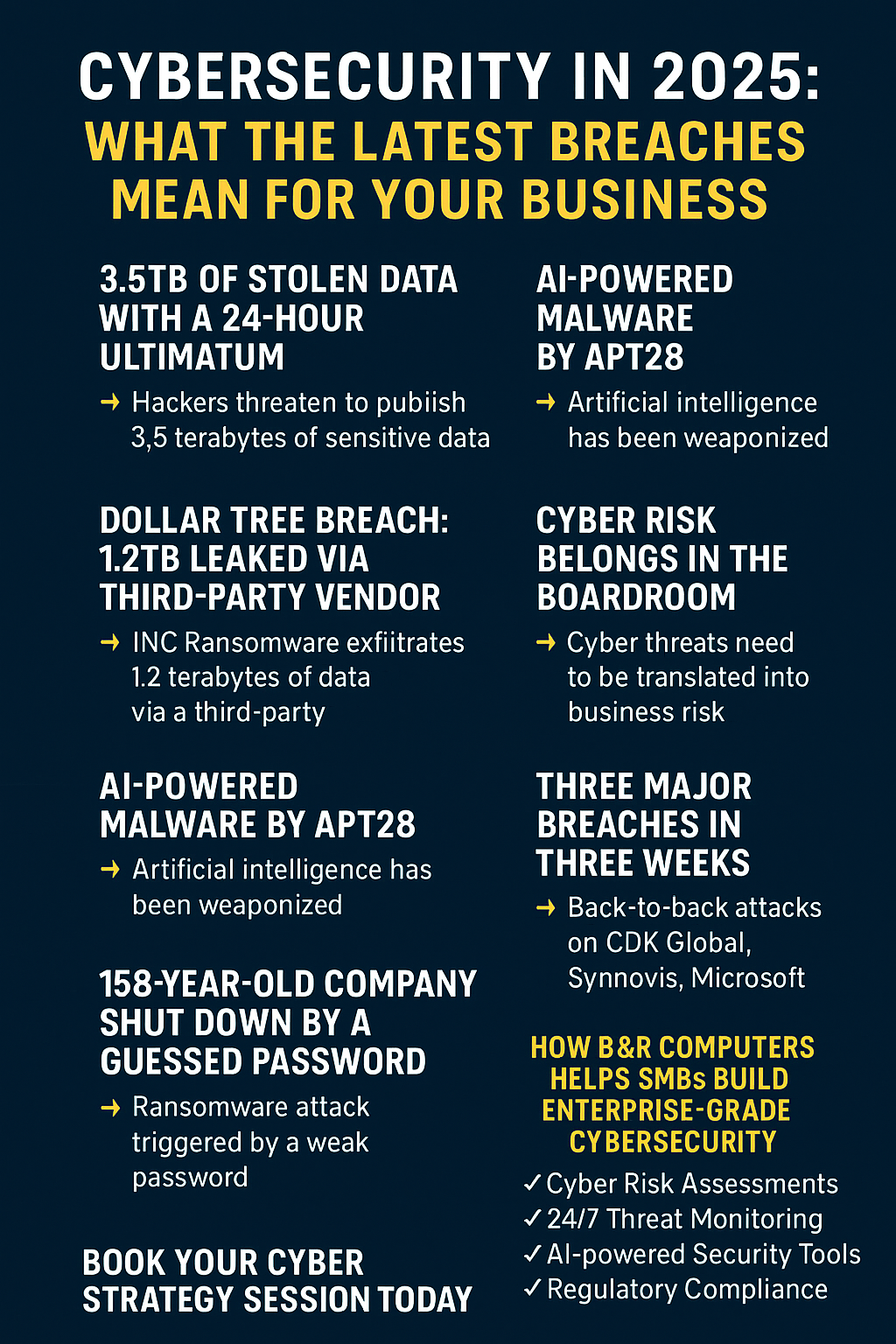

What Makes BEC Attacks So Effective?

Unlike the ransomware attacks that make headlines, BEC attacks fly under the radar by looking completely normal. No suspicious attachments, no obvious red flags: just what appears to be routine business communication. That's exactly what makes them so dangerous.

These attacks have become a billion-dollar problem, and here's the kicker: they work on even the most security-conscious teams. Why? Because they don't target your technology: they target your people and your business processes.

The Four-Phase Anatomy of a BEC Attack

Let's break down exactly how these attacks unfold, step by step:

Phase 1: The Reconnaissance Game

Before any fraudulent email hits your inbox, attackers spend weeks or even months studying your organization. They're not just guessing: they're doing their homework.

They start by scouring your website, LinkedIn profiles, press releases, and social media to map out your company structure. They identify key players: Who's the CFO? Who handles vendor payments? Who's authorized to make financial decisions?

In sophisticated attacks, they might even infiltrate your network with malware and silently monitor your email communications, learning your vendors, payment processes, and even executive travel schedules. They study writing styles, corporate lingo, and communication patterns to craft emails that sound authentically "you."

Phase 2: Setting Up the Deception

Now comes the technical setup. Attackers typically use one of two approaches:

Email Spoofing: They create fake email addresses that look almost identical to real ones. Think "ceo@yourcompany.com" versus "ceo@yourc0mpany.com" (notice that sneaky zero?). Your email client might not catch the difference, especially on mobile devices.

Account Compromise: The more dangerous approach involves actually breaking into a real company email account. Once inside, they can monitor conversations, set up forwarding rules to intercept payment-related emails, and strike at the perfect moment: all while using a completely legitimate email address.

Phase 3: The Psychology Attack

Here's where the real manipulation happens. The attacker sends a carefully crafted email that hits three psychological pressure points:

Authority: "This is your CEO speaking." People are hardwired to follow authority figures, especially in workplace hierarchies.

Urgency: "I need this done immediately: I'm in meetings all day." Time pressure prevents people from thinking clearly or following normal verification procedures.

Confidentiality: "This is a sensitive acquisition deal: keep it quiet." This discourages employees from asking colleagues or supervisors for verification.

Combined, these tactics create a perfect storm that overrides normal caution, even in security-aware employees.

Phase 4: The Payout

If the psychological manipulation works, the employee complies. This might involve:

- Wire transferring funds to a fraudster-controlled account

- Purchasing gift cards and sending the codes

- Emailing sensitive employee data like tax forms or payroll information

Once attackers get what they want, they move quickly to launder money or monetize data, making recovery nearly impossible.

Why Smart Teams Still Fall for It

You might think, "Our team would never fall for this." But here's why even cautious, well-trained employees get fooled:

It looks completely legitimate: When attackers compromise real accounts or study communication patterns extensively, their emails are virtually indistinguishable from genuine ones. Your spam filters won't catch them because they're not technically spam.

Authority short-circuits critical thinking: A request from the boss carries psychological weight that makes people hesitant to question it. Add urgency and confidentiality, and you've created a recipe for bypassed security protocols.

It fits normal business patterns: BEC attacks don't ask for anything obviously suspicious. Vendor payments, employee reimbursements, payroll changes: these are all normal business activities that happen regularly.

Time pressure kills verification: "I'm in a meeting, can't talk, just get this done" deliberately prevents the one thing that would stop the attack: picking up the phone to verify.

Common BEC Variations You Need to Know

BEC attacks come in several flavors, each targeting different vulnerabilities:

CEO Fraud: The classic version where attackers impersonate executives to authorize fraudulent transfers.

Vendor Email Compromise: Attackers hack a supplier's email and redirect invoice payments to themselves. One case we've seen involved $45 million stolen over two years.

Payroll Diversion: Fraudsters access HR portals and change employee direct deposit information, redirecting paychecks to their accounts.

Attorney Impersonation: Criminals pose as lawyers or legal representatives to request urgent transfers or sensitive information.

Building Your Defense Strategy

Here's the reality: traditional email security isn't enough anymore. You need a human-centered approach:

Implement the "Two-Person Rule": Any financial transaction over a certain threshold requires verification from two people, regardless of who requested it.

Create verification protocols: Establish clear procedures for confirming requests, especially those involving money or sensitive data. A quick phone call to a known number can stop most BEC attacks.

Train for the psychology, not just the technology: Your team needs to understand the psychological tactics attackers use. Role-play scenarios where employees practice questioning authority when appropriate.

Use multi-factor authentication everywhere: If attackers can't easily compromise accounts, they can't launch the most effective BEC attacks.

Monitor for suspicious email forwarding rules: Regularly check for unauthorized email forwarding that might indicate a compromised account.

The Small Business Reality

Don't think BEC attacks only target large corporations. Small and medium-sized businesses are actually preferred targets because they typically have fewer security measures and less formal verification procedures.

The good news? The same human-centered defenses work regardless of company size. In fact, smaller organizations often have an advantage: it's easier to pick up the phone and verify a request when you know everyone in the company.

Your Next Steps

BEC attacks succeed because they exploit the intersection of technology and human psychology. The most sophisticated email filters in the world won't help if someone believes they're following legitimate orders from their boss.

The key is creating a culture where verification isn't seen as distrust: it's seen as good business practice. When that "urgent" request comes in, the right response should be, "Let me just call to confirm this."

Ready to strengthen your defenses against BEC attacks and other sophisticated threats? At B&R Computers, we help businesses build comprehensive cybersecurity strategies that protect both your technology and your people. Contact us today to discuss how we can help your team stay one step ahead of cybercriminals.

Because in the world of BEC attacks, your best defense isn't just better technology( it's better-prepared people.)