Your morning coffee just got more expensive: figuratively speaking. While you were focused on running your business, 19 states have now passed comprehensive privacy laws, with 8 new ones taking effect throughout 2025. The compliance landscape just became a minefield, and most small business owners are stepping on every single explosive.

The reality? This isn't just another regulatory headache. These laws come with real penalties, real enforcement, and real consequences for businesses that get it wrong. Delaware, Iowa, Nebraska, New Hampshire, and New Jersey all flipped the switch on January 1st and 15th, 2025. Tennessee, Minnesota, and Maryland are coming later this year.

But here's what's really keeping cybersecurity professionals up at night: small businesses are making the same five compliance mistakes over and over again. And some of these mistakes could shut you down.

Mistake #1: Playing the "We're Too Small" Card

The Reality Check: State privacy laws don't care about your feelings: they care about your numbers.

Delaware's law kicks in at 35,000 Delaware consumers per year. Think that's high? Iowa drops it to 25,000 consumers if you make 50% of your revenue from selling personal data. New Hampshire? Just 35,000 consumers, period.

Here's the kicker: if you run an e-commerce site, have a newsletter, or collect customer emails for marketing, you might already be there. A small online retailer processing holiday orders could easily hit these thresholds without realizing it.

The Fix: Count your customers by state, not by how small your business feels. Set up tracking systems now to monitor consumer data processing by state. If you're anywhere close to these thresholds, assume you're covered and start compliance planning immediately.

Mistake #2: Assuming All State Laws Are the Same

The Reality Check: Each state wrote their own playbook, and they're all different.

Nebraska excludes small businesses as defined under federal Small Business Act: but that definition might not be what you think it is. Delaware gives you 60 days to fix violations until December 31, 2025, then it's up to the attorney general's discretion. Iowa gives you 90 days with no sunset date. New Jersey? Only 30 days.

The revenue triggers are completely different too. Delaware requires 20% revenue from data sales to trigger their lower threshold. Iowa wants 50%. Some states don't have revenue triggers at all.

The Fix: Stop thinking "privacy law compliance" and start thinking "Delaware compliance, Iowa compliance, New Jersey compliance." Each state requires its own compliance strategy. Create state-specific checklists and don't assume what works in California works everywhere else.

Mistake #3: Waiting Until Someone Complains

The Reality Check: Consumer rights went live the moment these laws took effect.

On January 1st, 2025, consumers in five states gained new rights to access, delete, correct, and opt out of the sale of their personal information. They didn't wait for you to figure it out: they started exercising these rights immediately.

The business owner who says "we'll deal with it when we get a request" just painted a target on their back. State attorneys general are actively monitoring compliance, and they're not interested in your learning curve.

The Fix: Build your consumer request infrastructure before you need it. Set up systems to handle data access requests, deletion requests, and opt-out requests within the required timeframes. Test these systems with mock requests from your team. If you can't fulfill a legitimate consumer request in the required time, you're already non-compliant.

Mistake #4: Ignoring the Data Assessment Requirements

The Reality Check: Some states require formal data protection impact assessments (DPIAs) for high-risk processing activities.

Montana requires DPIAs for processing activities created after January 1, 2025. Minnesota has similar requirements starting the same date. Delaware's kick in July 1, 2025. If you're processing sensitive personal information, using AI for automated decision-making, or engaging in targeted advertising, you likely need these assessments.

Most small businesses are flying blind here because they don't even know what qualifies as "high-risk processing." Spoiler alert: if you're using customer data for marketing automation, recommendation engines, or any kind of profiling, you're probably in high-risk territory.

The Fix: Audit your current data processing activities and identify anything that could trigger DPIA requirements. Document your data flows, processing purposes, and risk mitigation measures. If you're unsure whether an activity requires a DPIA, err on the side of caution and conduct one anyway.

Mistake #5: Treating This as a One-Time Checkbox Exercise

The Reality Check: Privacy compliance is ongoing operational work, not a project with an end date.

Colorado's biometric data obligations take effect July 1, 2025. Various opt-out preference signal requirements kick in at different times for different states throughout the year. Additional states are considering their own privacy legislation.

The business owner who thinks "we'll get compliant and be done" just signed up for perpetual non-compliance. Privacy laws evolve, enforcement guidance changes, and new states join the party regularly.

The Fix: Build privacy compliance into your regular business operations. Assign someone on your team to monitor privacy law developments. Schedule quarterly reviews of your privacy practices. Make privacy impact consideration part of your new product or service development process.

The Hidden Cost of Getting This Wrong

Beyond the obvious regulatory penalties, non-compliance creates hidden costs that can cripple small businesses:

Customer Trust Erosion: News travels fast in the digital age. Privacy violations damage customer relationships and make acquisition more expensive.

Vendor Relationship Complications: B2B customers increasingly require privacy compliance attestations from their vendors. Non-compliance locks you out of lucrative contracts.

Insurance Coverage Gaps: Cyber insurance policies increasingly require evidence of privacy compliance. Gaps in compliance can void coverage exactly when you need it most.

Your 30-Day Action Plan

Week 1: Inventory your customer data by state and calculate whether you hit any state thresholds.

Week 2: Implement basic consumer request handling systems and test them with your team.

Week 3: Review your current privacy policy and update it to reflect the rights consumers now have in states where you operate.

Week 4: Assess your high-risk data processing activities and determine which ones need formal DPIAs.

The privacy law landscape transformed overnight, but your compliance doesn't have to be an emergency. The businesses that treat this seriously now will have competitive advantages over those that wait for enforcement actions to force their hand.

The question isn't whether you can afford to invest in privacy compliance. The question is whether you can afford not to. With enforcement ramping up and consumer awareness growing, the cost of non-compliance only goes in one direction: up.

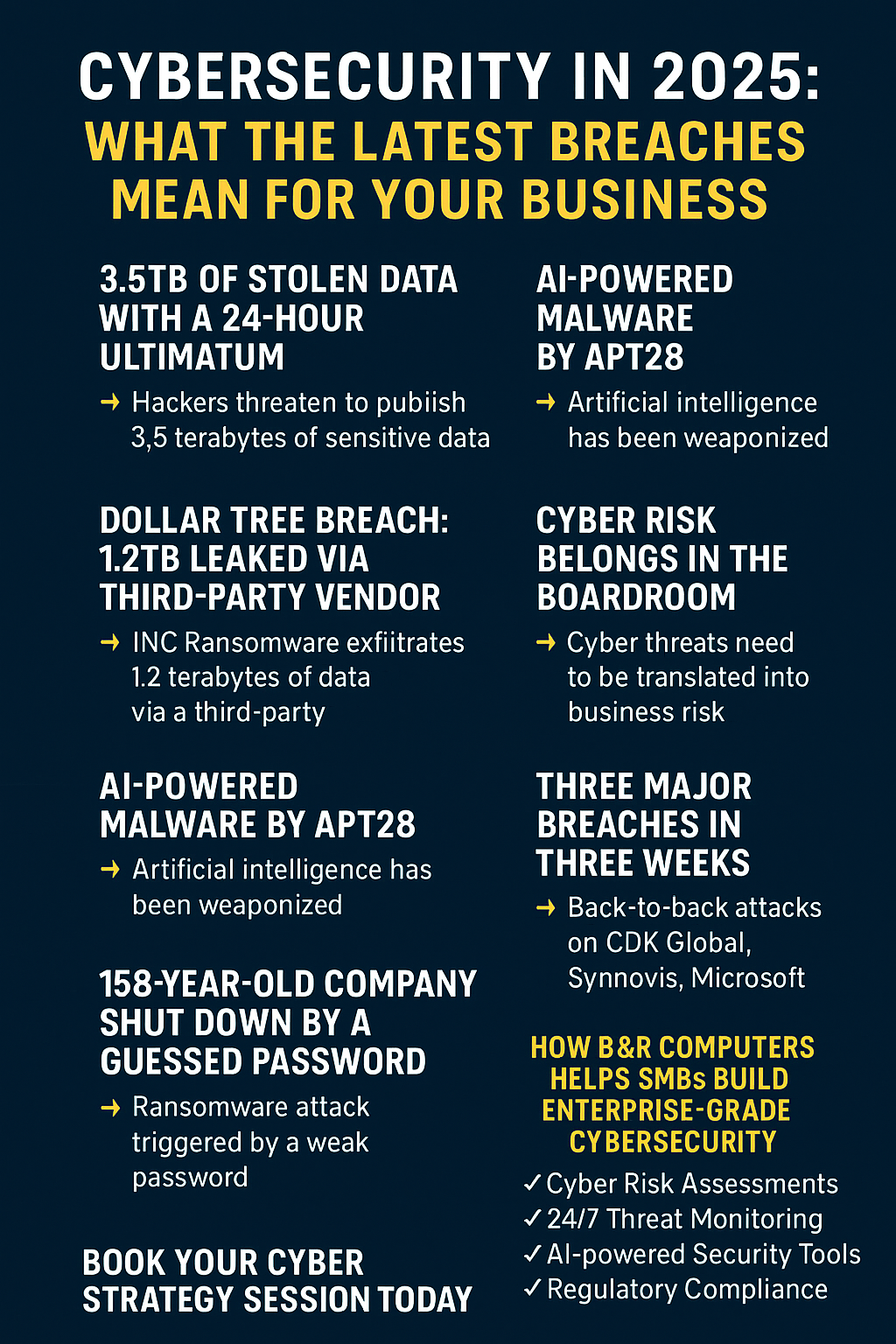

Ready to get your privacy compliance house in order before it becomes a crisis? Contact B&R Computers for a comprehensive privacy compliance assessment that identifies your real risks and creates a practical roadmap for protection across all relevant state jurisdictions.